What Does It Take to Generate a July Weather Story? And Other Stuff that Happened in June.

June 2025 in Review

This is going to bounce around a bit; the lack of a clear price function or a tangible weather story for this month gives me some flexibility.

It was a quiet weather month. Too quiet. I found myself frustrated as meteorologists tried to create stories out of thin air. I thought maybe we had caught a real catalyst—turns out it was just another TACO of sorts. Then we will shift our focus to what weather pieces need to fall into place to generate some weather excitement in July.

Throughout the month, we published several deeper dives: one on macro and inflation (links here and here), another on the growing need for AI in agriculture (here), and a nuanced overview of the changes underway in Argentina (here).

I wrote about how losing money is what teaches us, but with a caveat: making money builds biases, too. Personally, I’ve always favored the long side—bull markets, investment flows, and weather events are my happy place. I suspect whichever side we make our first big trades sticks with us.

Slow, grinding markets, low volatility, and the function of price to curb supply were never my forté. They make me uneasy. It’s like sitting around, waiting for the event that torpedoes your quarter. Interestingly, most older grain traders are wired the opposite way.

I still can’t bring myself to short corn with a $3-handle. It feels like collecting nickels in front of a steamroller. I know that’s been wrong over time—which is exactly why we built AiQ. Recognizing the bias is only the first step. Building a system to manage it? That’s the real edge.

So to everyone hopping on the short corn train—I wish you the best. I just can’t shake the feeling that something's coming and we’re running headfirst into it.

“ChatGPT: What is Research?”

There’s no substitute for human intuition in commodity markets. None.

Experience, judgment, and gut instinct can’t be coded. The best traders, operators, and managers rely on intangibles learned over years of mistakes and incremental improvement—things AI can’t replicate.

But used well, AI is a force multiplier. It boosts productivity, sharpens risk tolerance, and tightens operations. When you take good, probabilistic risks, your upside expands. If you don’t adapt, will your competitors also choose to stand still?

We embrace AI. We’re building with it. But we also know: your edge isn’t the tech. It’s how you use it.

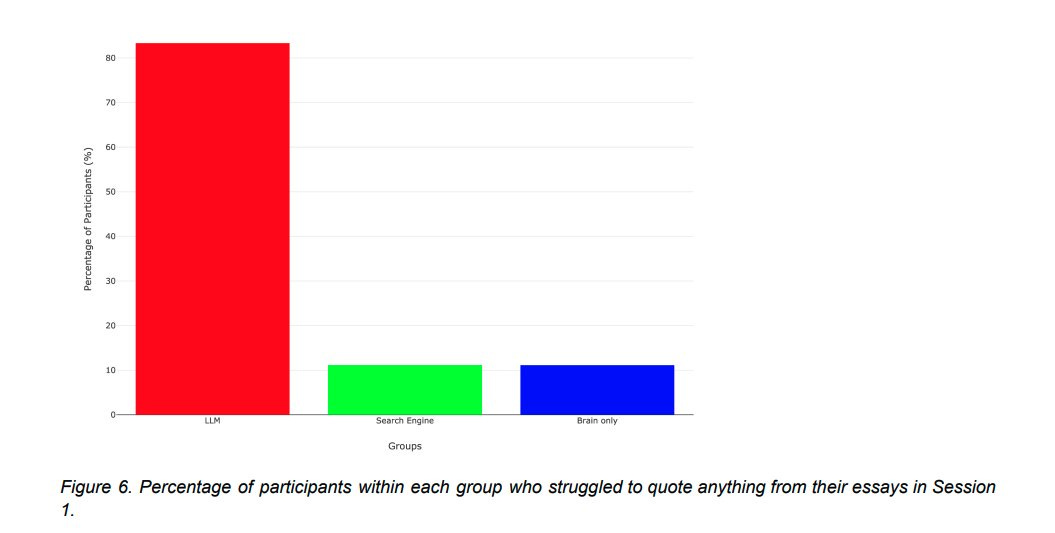

Consider this: an MIT study found that students using AI to help write essays struggled to recall their own work shortly after.

If AI becomes a crutch, was it worth it? Especially for younger professionals who may not have yet developed real skill sets.

That’s a challenge business owners face: incorporating AI, while maintaining your edge and developing talent. Serious considerations in a rapidly evolving world.

The Israel-Iran Catalyst Was Worth a Shot—You Be the Judge

Wheat, soybeans, cotton, and the dollar were commodities we zeroed in on during the month. Weather risks and stretched sentiment had them set up for a sharp move—just needed a spark.

That came when Israel bombed Iran. We flagged the asymmetric setups right away: early enough in the month that shorts were exposed, and weather could still matter.

We shared the trades on the morning of June 13. The follow-up came on June 23.

We just weren’t sure which TACO we would get. The entire conflict lasted less than 8 trading sessions. If you sold the rally, congratulations. The most surprising of the three was how little bounce the dollar could muster from such negative sentiment.

Now, we can all get back on board with the “wheat’s never going to rally again jokes.”

Reuters reporting has caught our attention. I suspect it’s a combination of journalists trying to do more with less—such as KPIs tied to clicks and the integration of AI. Years ago, an insightful article about quarterly stocks would have led off the day after the USDA report; now we get a bearish crop progress headline.

Reuters has become my contrarian bellwether. I read the headlines and ask, “Is this a good fade?” Maybe it was the plan all along to get me to read their news again. The AI is already winning. 😂😂😂

Is corn's decline over when Reuters cites the best conditions in 7 years?

Is a “Japan deal” closer than we think?

June Was A Disappointing Month for the Bulls

We’re not a traditional weather company, so we don’t write about weather just to fill space. Here’s a list of weather risks that did not pan out in June.

Pakistan hit record heat—but temps cooled late in the month as India’s monsoon brought rains north.

Australia’s dry spring risked delaying planting in WA and SA, but both saw rains ease conditions by mid-month.

China shifted from extreme heat in the east to cooler, wetter conditions across key grain belts.

Russia’s Sukhovey winds were a dud—no heat, minimal impact.

Canada’s Prairies and Mexico’s Sinaloa got rain, but both still need more by mid-Julu.

The one real deterioration? Europe. France and Eastern Europe are under pressure. Watch the ridge over the Balkans—it becomes a bigger deal if it drifts northwest toward central Romania and Ukraine.

The Prescription for a July Weather Market

Three things need to align to trigger a legit weather scare and catch the market off guard:

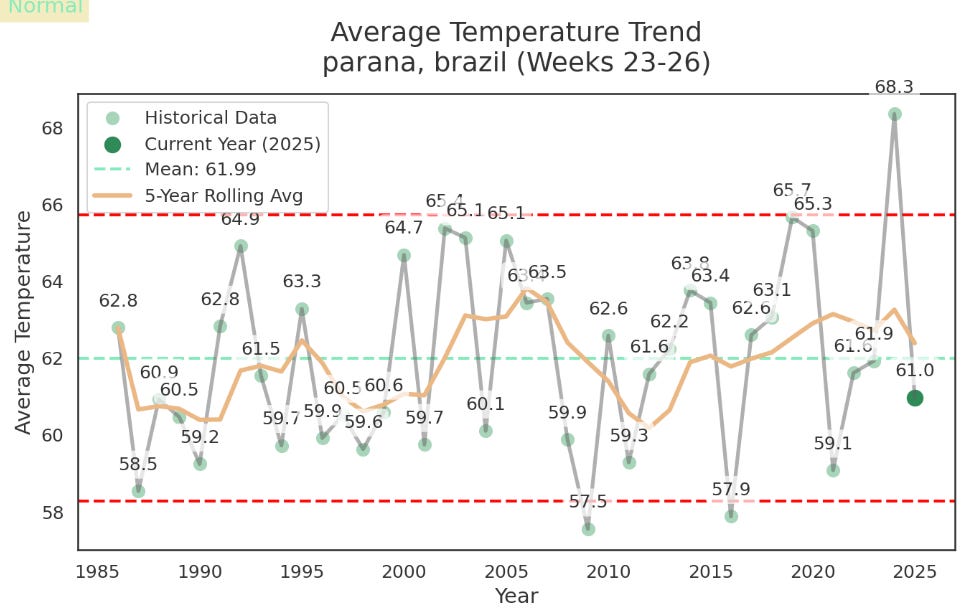

Brazil’s harvest lag continues, and farmers stash grain while domestic buyers quietly mop up supply. That’s already underway, helped along by a softening dollar keeping the U.S. competitive. The images below show cool, wet temps across the South over the last month.

A dry stretch sneaks up and spreads. Think early fall 2024—rains ending, fading soil moisture, and traders too focused on backward-looking crop tours. The trade allowed inertia to push yield estimates higher, all while one of the driest fall periods on record set in.

Eastern European Weather spooks buyers. From food companies to end users in the MENA region, there has been virtually no pressure on buyers to chase rallies or book anything forward. If buyers of European grains can sit comfortably for the next 30 days, a Northern Hemisphere weather market was not meant to be.

Let’s Review How 2024 Ended

The ProFarmer crew wrapped up around August 22, touting massive pod counts and near-record corn yields. Nobody paid any attention to the fact that it completely stopped raining across the heart of the I-States. The dryness set in over Indiana and then moved Northwest. Here is an excerpt from Reuters last fall.

NAPERVILLE, Illinois, Aug 26 (Reuters) - Record yields are already predicted for U.S. corn and soybean crops, but some of the estimates, particularly for soybeans, are becoming rather lofty.

Last week’s Pro Farmer Crop Tour confirmed massive pod populations in the soybean fields, though overall corn yields were not the best ever measured.

It wasn’t until the September WASDE that anyone seriously took notice that the weather wasn’t as perfect as assumed. Until then, every survey-based forecaster was ratcheting yield expectations higher—classic circular logic. Each group leaned on the others’ estimates and a few anecdotal crop tours to reinforce the same bias: “The crop is big and getting bigger.”

Then reality hit.

Yields were ultimately revised down 4–6% from peak expectations over the next five months. The lesson? When everyone agrees, it usually means there’s an opportunity to catch people leaning.

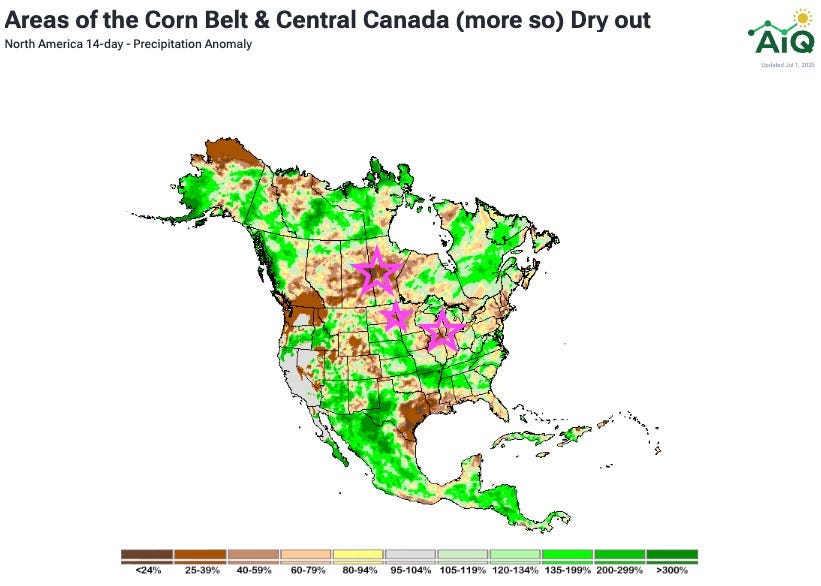

What Needs to Happen over the next 2-4 Weeks

The latest U.S. forecast is more threatening than it looks. Around 30–50% of the expected precipitation in Illinois and Indiana is stacked at the tail end of the forecast window. If this dry bias rolls forward through the holiday weekend, both corn and soybeans are in play.

It’s not yet time to take on sizable risk, but consider your margins. Without a big EU issue or Brazil taking a hit, we stay range-bound. But there is dryness creeping in. It’s a stealth setup that calls for attention.

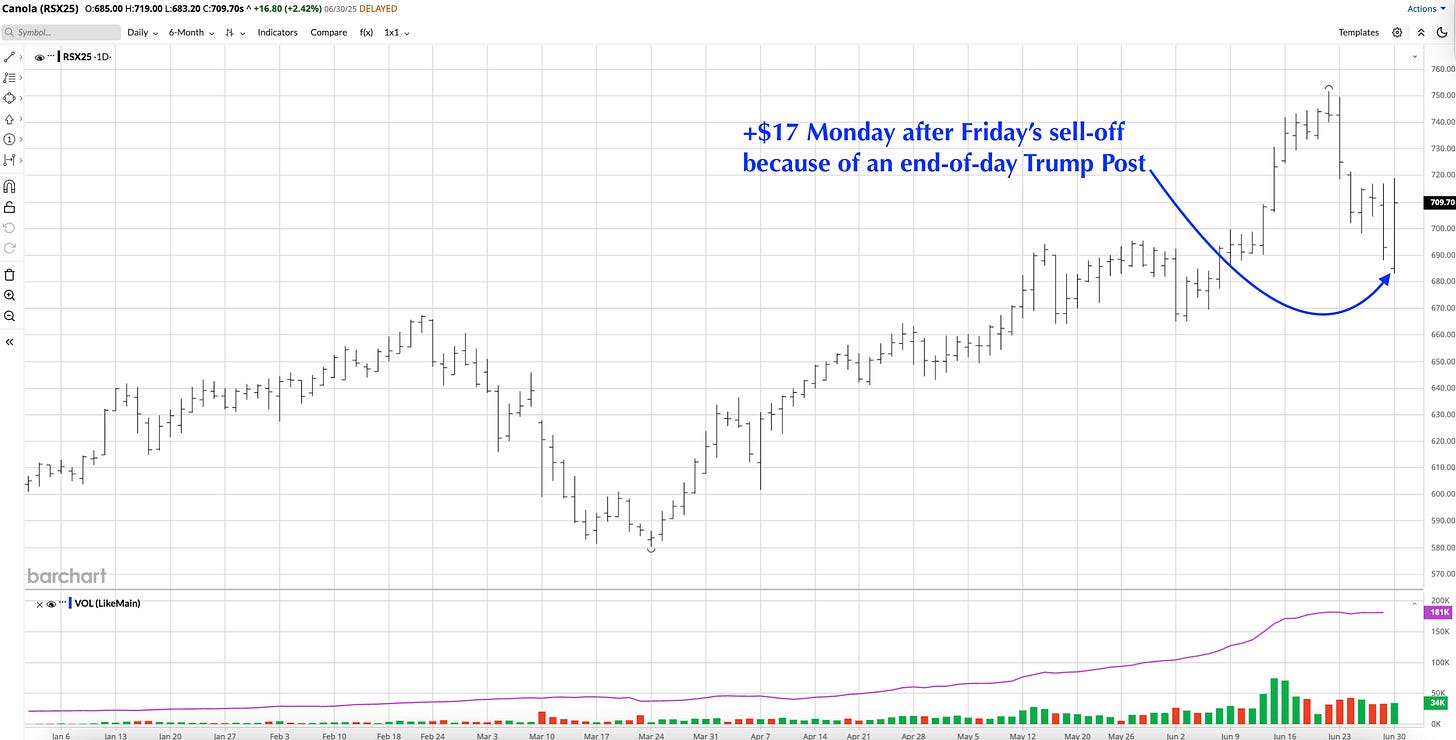

The icing on the cake would be if Canada quietly deteriorates while canola stays under pressure from the ongoing Trump-Carney tit-for-tat negotiations. Tomorrow’s open is worth watching as Canadians come back from Canada Day to a drier forecast.

One has to wonder how many traders dumped their positions going home Friday, who could end up chasing futures higher Wednesday or Thursday this week?

Soybeans and Cotton Will Stay on Our Radar

Soybeans are flirting with major support near $10, and with enough weather risk on the table, we continue to urge caution. As we've said before, we have no interest in pressing shorts at these levels.

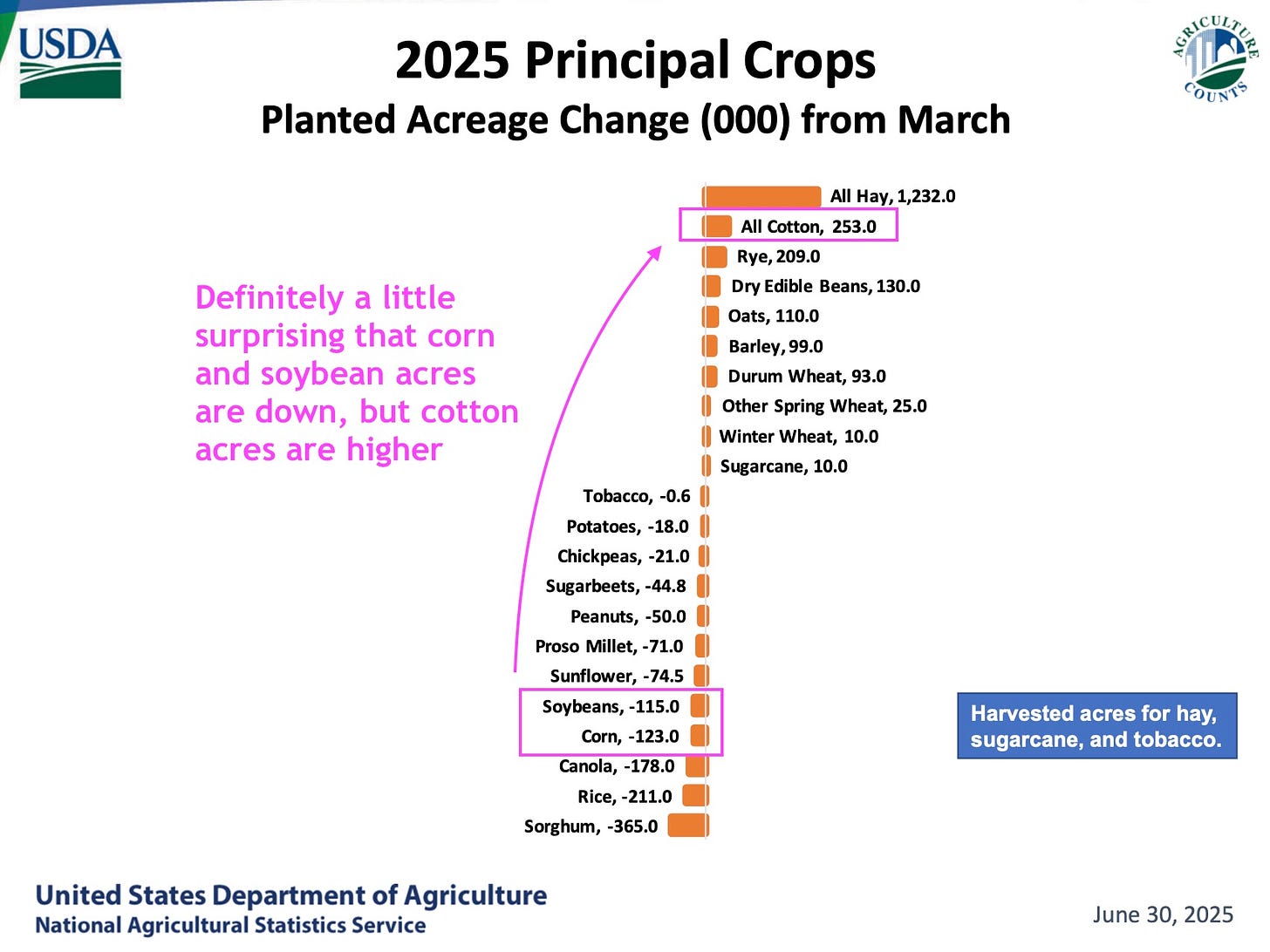

Cotton, meanwhile, is holding up better than expected given the USDA’s surprise on acreage. We remain skeptical that growers added acres in the Southwest—milo and corn penciled out much better this spring. The weather in China and Pakistan is likely to push yields below trend again this year.

Conversations with gin owners and large producers suggest that few intended to stick with cotton unless they were integrated into their supply chain or owned the inputs and equipment. There are areas in Texas where farming is profitable only for insurance at these prices.

The acreage adjustment feels off—see the area circled in blue below.

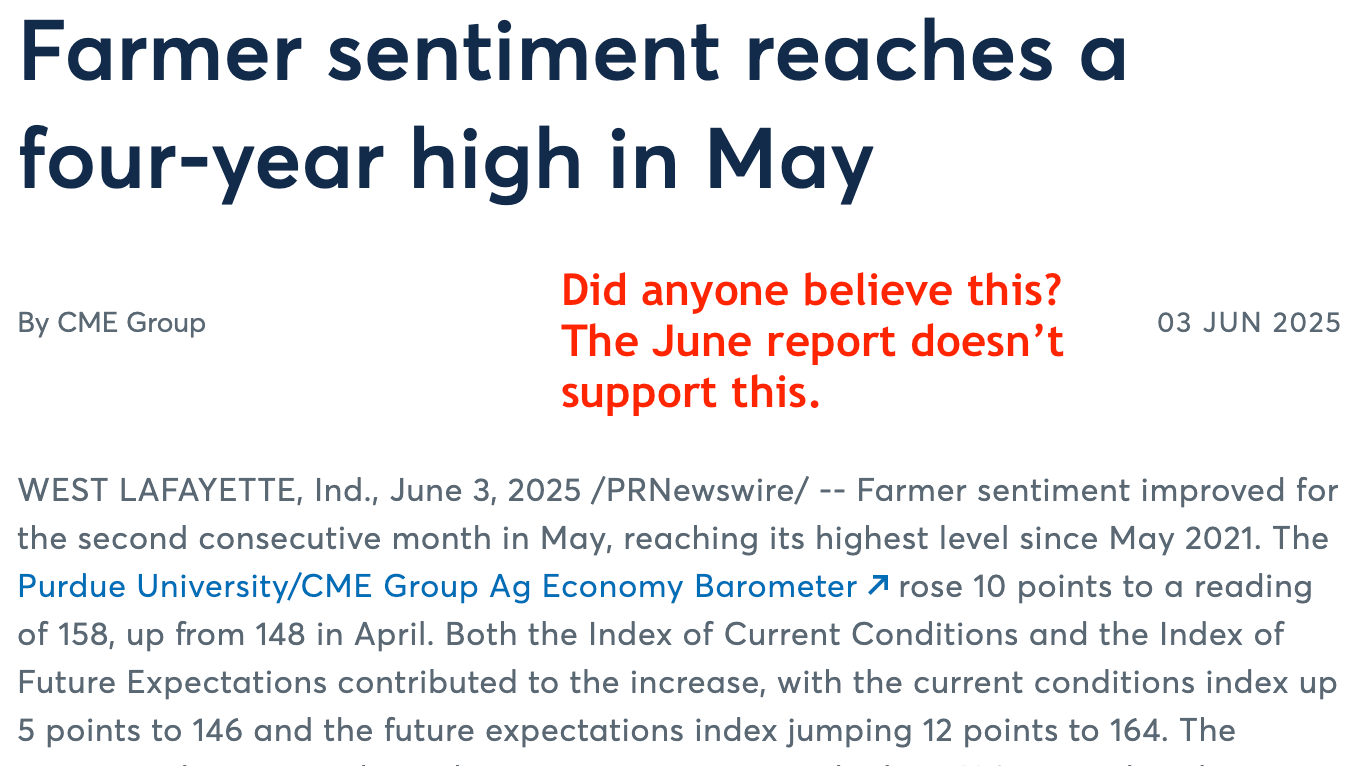

Survey Work Is NOT a Primary Data Source

If you’re still paying for survey data as a primary source or decision input in 2025—stop. Does everyone remember Lanworth? Satellite data wasn’t either. It was an expensive lesson.

There is one survey that moves markets at scale: the USDA’s. It’s enormous, unreplicable, and deeply entrenched in the seasonality of our industry. It will get traded, and later adjustments will mask any deficiencies.

Hedge funds with cutting-edge data science teams and decades of computing power have tried and failed to extract much edge from it. Not because they aren’t smart—but because the training data is lacking, and each year is uncertain in different ways.

There are fundamental and statistical reasons commodity markets will never price with the efficiencies of equities, and surveys will be an unreliable indicator at best.

Just days before USDA is expected to release its new estimates, the Kluis Commodity Advisors/Successful Farming Acreage Survey revealed American farmers planted over 1 million more corn acres for the 2025/2026 crop year than USDA previously forecast. Soybean and wheat acres were pegged lower.

According to the survey results, the acreage for corn and soybeans combined is 179.3 million versus 178.8 million in USDA’s March 2025 Prospective Plantings report. The survey attributes this increase to a 500,000-acre reduction in spring wheat.

The odds that a new survey shop will suddenly add meaningful value? Low. As in, rock bottom has a hidden basement low. At the tail end of the unlikely distribution curve. That’s not a knock on anyone’s hustle—just a reflection of the math.

Human surveys in agriculture? File them next to Japanese candlesticks, moon cycle charts, and Elliott Wave “theories.” They create great posts and occasionally hit a home run, but not consistently profitable or useful. This one from Purdue in early June still has me scratching my head.

Housekeeping: AiQ Roadmap

Now let’s talk about what we’re doing.

Starting soon, we’ll move more content behind the paywall—while keeping the weekly emails free. The price stays low at $8. The point is not to gatekeep, but to provide a trusted signal to farmers and passive investors seeking objectivity in a landscape full of noise. We value the things we pay something for—that’s human nature.

Substack is our medium of choice for writing because it's accessible and direct. We want to be your null hypothesis. If you're testing a new service, benchmark it against us. AiQ's signals won’t always be right—nobody’s are—but they will always be grounded in data, not narrative.

See a service pumping grand headlines, then hedging with 50/50 tweets? Or sharing market opinions as the Holy Grail without a clear signal? You already know the answer to its value.

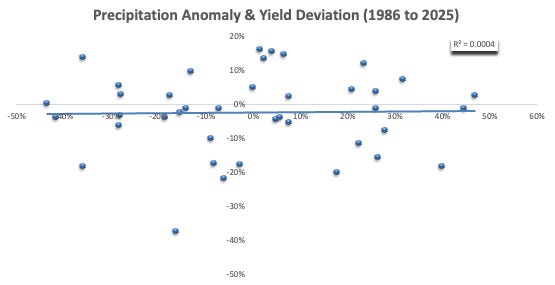

I posed this question: “Is there really no correlation between yields and precip in Brazil?” While the obvious answer is that technology is offsetting the decline in precipitation, there are other insights, such as the acceleration of yields in the face of extremely poor rainfall in recent years, that guide how we can explore the data better.

AiQ is built by traders using AI, machine learning, and big data. No bullish spin when the numbers don't support it. No bearish trend chasing when risks skew heavily topside. We’ll try to answer the hard questions with data (case in point: Last Week’s Monster Safriña Prediction) and point out the clickbait designed to jump on the latest trending topic (see just above).

You will hear a lot of “quiet weather markets” and “no position is a good position” from us. Occasionally, we will post specific trade ideas, and follow them—platinum has been a good one. We raised attention to the 16-year breakout potential in early May, and updated that it may be overbought this past week. We still expect significant upside into early 2026—the market will likely front-run this Fed debacle. As I have written before, be careful, I am the worst platinum trader you know.

And finally—a warning. The AI grift is coming fast. Expect a flood of ChatGPT-stickered spreadsheets dressed up as “intelligence.” Quality will be hard to spot. First movers are rarely the best movers in these situations.

If you see something that doesn’t pass the sniff test, send it our way. We’ll be happy to take a look. We wish everyone a great start to the third quarter. Please let us know if we can be of any help.

Thank you for reading. Please reach out to Nico@archaiq.ai with any suggestions on how to improve our products or if you're interested in exploring new opportunities with ArchaiQ. Sign up for our free weekly newsletter at www.archaiq.ai. Each morning, we will add some daily notes to our Substack chat (link here).

This is not trading or investment advice. Trading Futures is a high-risk activity; please consult with a professional.