How Deregulation and Expensive Money Killed Argentina's Zombie Economy

Corruption, Easy Money, and Inflation Defined the Kirchner Era

We are bullish on Argentina due to Javier Milei’s free market reforms and his ability to force growth from the public sector to the private sector in record time.

We are bullish on Argentina due to the tailwinds created by the Trump administration. The latest IMF/World Bank bailout was unusually generous for a chronic defaulter and provides the current government with a buffer to support the currency and suppress inflation heading into the critical October elections.

There will be inevitable accusations that Argentina is not meeting its obligations—this is a feature of the latest deal, not a flaw.

Our bullish view is reinforced by the second-order effects of Trump’s flawed trade agenda and the upcoming capital account restrictions. Here’s the context:

Trump’s war on trade was a failure from the beginning. The U.S. current account deficit (dollars flowing out while goods flow in, simple version) remains deeply negative and won’t rebalance without a significant dollar devaluation.

It’s controversial because it will cause inflation and take time. It’s why “TACO Trump” has largely walked back “Liberation Day”—and, to his credit, folding was the right move. The most realistic U.S. objective in the near term is a strategic realignment of supply chains within the Western Hemisphere. Argentina is well-positioned to anchor that shift.

The capital account—financial flows—will be the next target, and signs in the latest tax bill suggest those measures will begin soon. The remittance tax is the first example, but others will follow. Think of them as small financial penalties on foreign ownership of U.S. assets—what Warren Buffett would describe as “reclaiming the little pieces of America that have been sold off over the decades.”

This is not a new concept, and should have been part of the approach before alienating allies and trade partners on “Liberation Day.” Warren Buffett penned this famous article 22 years ago.

Debt and Chronic Deficits Aren’t Only the US

Below is debt-to-GDP data for the G-20 through 2023. A few countries show one-off surpluses—mostly driven by temporary external factors, like high oil prices in Saudi Arabia.

Meanwhile, the U.S. is running structural deficits nearly twice those of Europe, limiting its flexibility. In contrast, Europe retains more fiscal room to support defense and industrial policy. To meet Trump 2.0 manufacturing targets, the U.S. will depend heavily on sustained foreign investment.

Did you catch that? The Trump administration’s next revenue solution will be to tax foreign financial flows and rely on foreign investment because the deficit is moving in the wrong direction again.

Fast forward to 2025, and the U.S. deficit rises even as its growth outperformed peers. Markets are increasingly punishing countries with persistent fiscal imbalances—except the US financial markets. Until now?

Take Brazil: each quarter brings a new record trade surplus, yet Lula’s expansive social programs consistently outpace revenue growth. Still, despite the growing welfare burden, Brazil is close to balancing its budget, thanks to strong global demand for its agricultural, mining, and commodity exports, as well as huge foreign investment.

Brazil’s weak currency is a structural advantage for its farmers, keeping production costs more competitive than their U.S. counterparts. For any meaningful shift in long-term trends, the BRL would need to trade stronger than 5.2—but most economists now project it to weaken further, potentially nearing 6 by year-end. Trump’s policy proposals, however, could change this trajectory.

Capital Account Controls Are Forthcoming

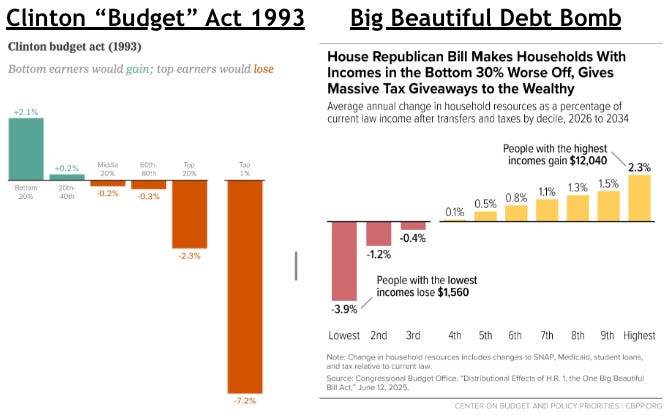

In the U.S., the real deficit for 2025 is approaching 7% of GDP, and tariff revenues are unlikely to make a meaningful impact. Instead, the government is pivoting toward taxing capital account flows — including the remittance tax in the Big Beautiful Debt Bomb Tax Bill.

While taxing remittances will be messy and difficult to enforce, taxing foreign ownership of U.S. stocks, bonds, real estate, and even dollars will not. Let that sink in: the very assets that have made American asset owners extremely wealthy are the easiest targets for a new wave of capital account taxes.

Back in April 2025, we flagged that DOGE wouldn’t save the system money and that "Liberation Day" would become a policy dumpster fire. The writing is on the wall: capital flows are the next revenue source, and even more important after the regressive nature of the proposed tax cuts.

To appreciate the most convenient path forward for the US politically, look at Argentina. Its prime farmland sells at a 30–40% discount to equivalent U.S. acreage, and marginal land goes for just 10–20%. Why? Years of currency controls, export taxes, and restrictions on foreign ownership gutted asset values. Inflation doesn’t just eat incomes—it eventually eats the economy—hence my crocodile metaphor.

Per Person, Argentina Is Wildly Resource-Rich

The chart below, courtesy of our friend Howard, highlights Argentina’s paradox. The country’s greatest strength—its vast natural resource wealth—is tightly controlled by a concentrated voting bloc and elite class centered in Buenos Aires. This power imbalance has long defined Argentina’s political and economic dysfunction. By Western standards, Argentina is underdeveloped and struggling. And yet, its population has long enjoyed access to healthier, protein-rich diets than most Americans and universal free healthcare. Let that sink in.

Please argue diets with me. Life expectancy in the USA and Argentina is nearly identical, with the USA's per capita GDP 7x.

I will bet you a triple… excuse me, double quarter pounder, I didn’t realize you were on Ozempic.

The Zombie Economy to Bank Credit — Why Have You Not Heard About This?

Keep reading with a 7-day free trial

Subscribe to Nico AiQ to keep reading this post and get 7 days of free access to the full post archives.