Raise Your AiQ: Inflation Is NOT High Prices or a Monthly Calculation (Part 1)

Inflation and Currency Destruction: Learning from Argentina's Fiscal Dependency

The phrase Becoming Argentina is meant to highlight unsettling parallels—not to equate the two countries directly. The United States is not Argentina. Even when strained, its institutions remain far more robust, and the dollar’s global role ensures continued demand for U.S. assets.

That said, the shift toward fiscal dominance and late-stage debt cycle dynamics bears a striking resemblance to patterns that have long plagued Argentina.

While the debt has been a flashpoint for several administrations, the transition to a politically motivated, fiscally dominant economy of the last three (Trump 1.0, Biden, Trump 2.0) is forcing new questions regarding trust in the dollar, the US as the favored trade partner, and the free market’s role in 2025.

Snarky X Troll: Sure, Nico, there may be a coordinated effort to weaken the dollar and suppress rates, but it’s still the brightest bulb in a dim house.

Nico: That was extremely helpful. That's why America fought two world wars, polices the oceans, and backstops global finance—to be slightly better than Uganda and France.

The US economy has little risk of echoing Argentina's growth post-Repsol nationalization (2014-2024). Readers could complain that the headline is an exercise in clickbait hyperbole. What is not hyperbole is the pain—erosion of wealth, economic and political disillusionment, and growing inequality—for average Americans that will resemble the decades of decay for middle-class Argentines.

Inflation is the cancer metastasizing across the economy, but it’s important to acknowledge that inflation is not a uniform experience from one country or state to another. The comparison-even within America-is not apples-to-apples.

This past week offered a perfect contrast of why the US will remain a foundation of the global economy for years to come.

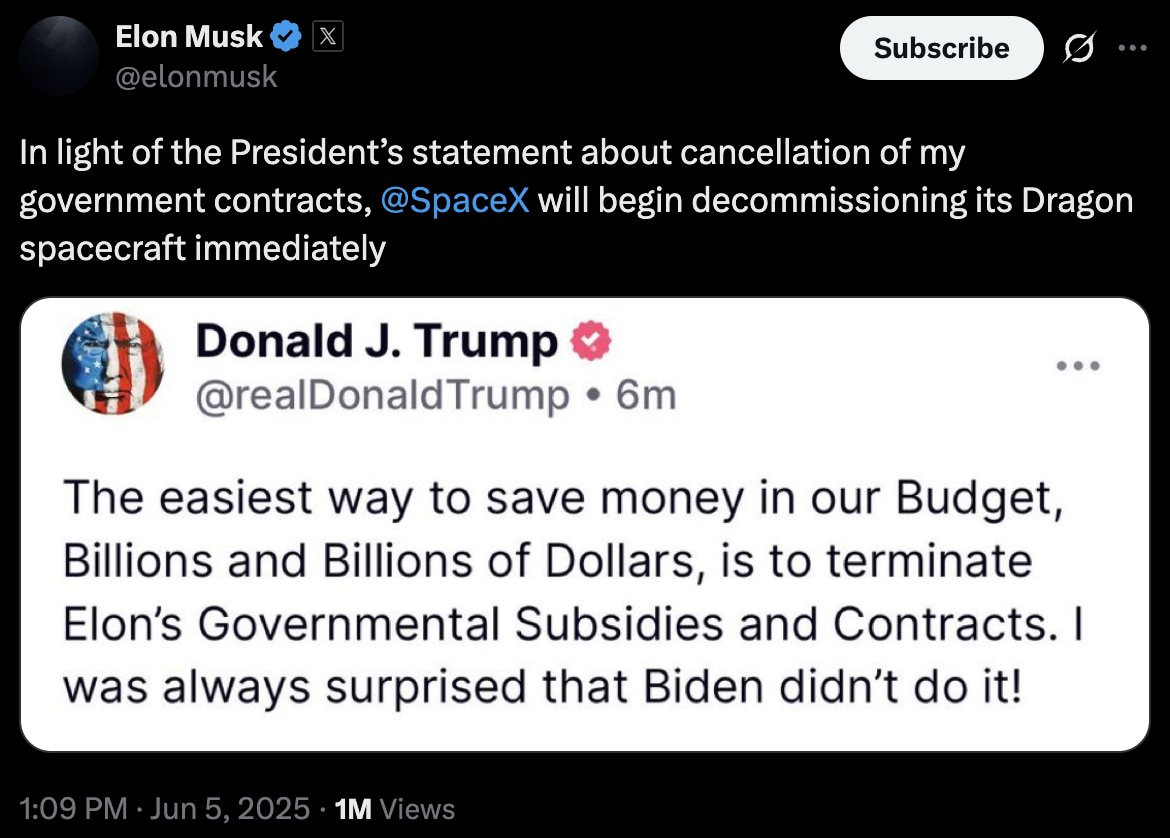

On June 5, the sitting President of the United States engaged in a public dispute with the world’s richest man—who in turn implied that presidential misconduct may have influenced the suppression of key information related to Epstein. Elon struck an acute chord when he said the President’s mandate resulted from Elon’s money and influence. He then threatened to take his rocket and go home. The President countered with accusations of drug abuse, removal of government contracts, and “serious consequences” if he opened his war chest to political rivals.

The stuff emerging market dramas are made of!

The bond market barely flinched. In fact, markets opened strong on Friday, as if on queue. The system’s reaction function is to assume stability in America and return to business as usual. This is America, we don’t do this.

We rationalized it away. A freak occurrence, blown out of proportion, tabloid fodder between two of the world’s megalomaniacs narcissistic egotists.

But this is not a one-off. This is a testament to the strength of American financial markets and the lack of a credible alternative.

Consider the Biden era.

The country spent four years under the leadership of a cognitively diminished President (putting it mildly). And yet, during that time, the administration managed to pass some of the most sweeping domestic investment packages in decades (CHIPS Act & Inflation Reduction Act). Meanwhile, the U.S. dollar soared, and foreign capital flooded America’s financial markets.

In virtually any other economy, this level of political dysfunction would have roiled equities, crushed bonds, and sent the currency into free fall. But the United States—its markets, institutions, and rule of law—absorbed it all with remarkable stability.

This is the context in which my “Becoming Argentina” series must be understood. The warnings about fiscal dominance and looming financial repression are not doomsday speculation—they’re grounded in an understanding that America’s resilience, while extraordinary, is not infinite.

The intention is to stay outcome-oriented. What does this mean to people and markets? The focus needs to be on the results. How policy outcomes manifest and cascade from the top across the markets and middle class.. This government has pivoted from its promise of deregulation and fiscal responsibility to central planning and fiscal dominance. This has grave implications for Americans. While the US will not BECOME ARGENTINA, the feeling for everyday Americans will be eerily similar to what Argentines have felt as their politicians received monthly wage hikes — always staying one step ahead.

The Trump-Musk Breakup Began Legitimately

Set aside all the White House drama, and focus on what has changed. Trump’s commitment to getting America on a sustainable financial footing for Main Street and America’s future generations died sometime over the last 45 days.

Scott Bessent’s 3-3-3 died 💀❌

Trump’s commitment to balancing trade 💀❌

Controlling the deficit to protect entitlements 💀❌

Responsible fiscal/monetary policy 💀❌

Elon’s actions suggest DOGE was intended to reduce waste and cut spending. The Big Beautiful Debt Bomb Tax Bill will add $3-5 trillion over the next decade. I don’t think DOGE ever had a chance to address government spending, but Elon did—this is all that matters. The President needs to get his Bill across the finish line in whatever grotesque form it takes, and this did not sit well with Elon. That’s what we are told sparked some of the more dramatic goings-on.

Inflation is NOT a Statistical Data Set

Background on money creation, inflation, and price shocks:

The legislature sets the rules for money creation. Government agencies report monthly inflation data. The Fed, Treasury, and commercial banks create money on the scale needed to drive domestic inflation. Other entities create money, but it requires policy to do it at a scale that becomes “inflationary.” Tariffs, the pandemic, the War in Ukraine, etc., can all cause one-off or limited price shocks, but are not inflationary in the long term.

High prices, supply chain disruptions, and price-gouging made inflation the top economic issue for most Americans during the 2024 elections. Americans have been the most sensitive to price changes since the 1970s and the oil embargo.

Definitions of inflation:

Government money creation. The term “printing” gets thrown around, but most money creation comes from commercial banks extending credit. Market interest rates incentivize economic behaviors. Monetary policy has been the main lever since the late 1990s, but as monetary policy diminished (the result of ultra-low rates and Fed balance sheet expansion), fiscal dominance stepped in.

The government (BLS) calculates consumer, citizen, and business inflation rates. We know them as CPI, PPI, and PCE. The monthly and annual price changes of most goods consumers buy or must have (healthcare, childcare, education, etc.), and expenses that impact American businesses. The monthly CPI includes 80,000 goods. This is not a comprehensive list, but it provides a flavor.

The day-to-day purchasing power in goods or services of each dollar or take-home income is how Americans feel inflation.

The formal definition does not matter to people. They buy a home once every 5-10 years. They rent an apartment once per year. If their healthcare and groceries go up, they feel it. Even if wages are rising, Americans know it if it does not outpace healthcare, education, utilities, etc. Their purchasing power has diminished.

Purchasing power is the value of a currency expressed in terms of the quantity of goods or services that one unit of money can buy. It declines when prices rise (inflation), and increases when prices fall (deflation).

The Unanchoring of Prices

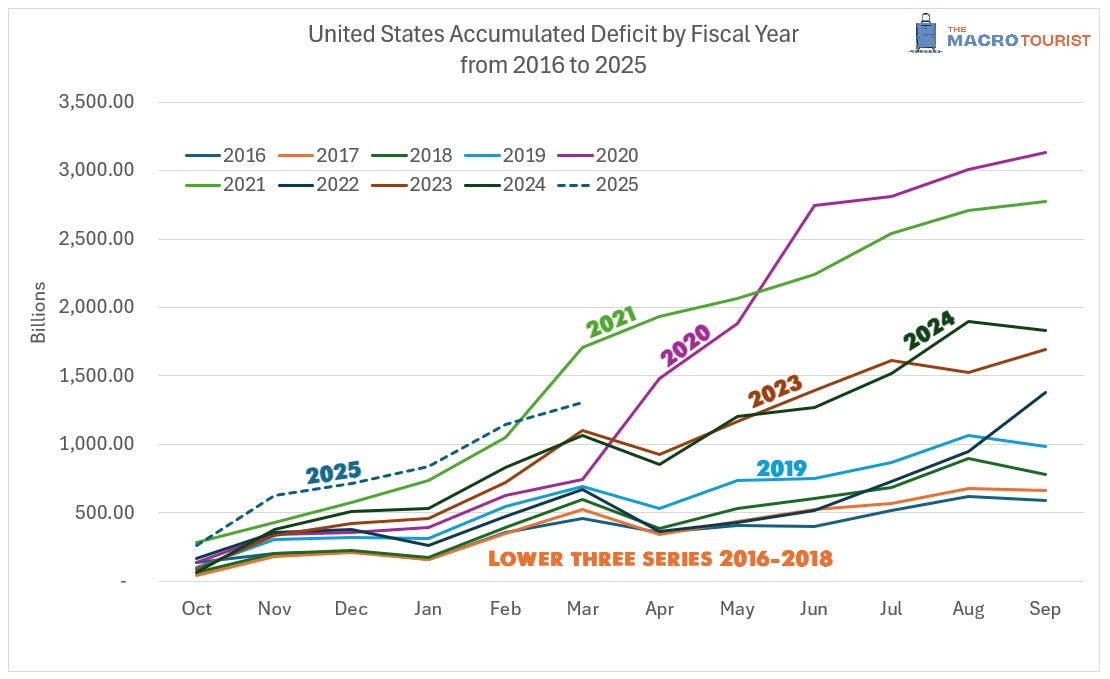

The Trump response to “2 weeks to stop the spread” is the largest money printing-palooza in history. The 2020 deficit reached $3.3 trillion, and $2 trillion alone was added in 4 months.

Take the Payment Protection Program. A poorly designed cash infusion with virtually no oversight that provided privileged access to the wealthy and scammers alike. Donald Trump, Republicans, and Democratic lawmakers alike will never audit what went on because they know exactly what the bodies will show (CNBC article here).

In the aftermath of the pandemic, inflation wasn’t merely a side effect — it became the defining feature of the economic landscape. Recognizing the dynamics of inflationary environments, companies seized every opportunity to justify raising prices.

The Russian invasion of Ukraine was the first major catalyst. Economist Sam Rines aptly coined the term “Price-over-Volume” (PoV) to describe the emerging corporate strategy. PepsiCo, being an early and notable example, began hiking prices, even at the cost of declining volumes. It worked masterfully.

Fast-forward three years, and the pattern persists. Rines continues with his knack of catching the latest C-Suite “excuses” for the next price hike.

A Thought Exercise: How Would You Fuel Inflation?

Forget about Trump or current political fights; let’s explore this thought exercise. What could I do if I wanted to create entrenched inflation in America?

Actively weaken the dollar, whereby foreigners would become routine sellers.

Push citizens into highly speculative activities (to keep up) or hard assets (to protect) against a weak dollar narrative.

I would raise wages and eliminate cheap labor (closing the border is the surest way because of illegal labor).

Deficit spend in the pursuit of nominal growth, inflation masks/solves my deficit spending addiction.

Tariff cheap imports, a major reason for the deflationary decade post-GFC.

Support home prices and the boomer wealth effect, while limiting any additional supply availability (regressive policies & high mortgages).

Ignore the bond market signals, thinking monetary policy can be a structural fix for many ills.

Allow 2.5-3% baseline inflation to become entrenched, even as 6-8% mortgages price out single families and young home buyers.

Regressive tax cuts, starting with corporations, while balancing the budget with cuts to welfare programs and services for the lower classes.

Reduce the government’s role in addressing income inequality as a societal ill.

Based on the above, a takeaway might slightly modify the famous Barack Obama quote.

Workers, veterans, and families did not build this country; large pools of concentrated wealth did.

America Chose Inflation. But, Why?

There are two different avenues to explore. The first is political. I don’t know why Trump abandoned fiscal responsibility so quickly, other than that this has been his reaction function since the pandemic, and he was never held accountable.

His ballooning wealth from crypto is another concern. It’s difficult to make a case that unregulated crypto, shareholder capture, and unanchored inflation are good for the Americans who elected Trump or the Republican party in 2028 and beyond. Yet, the messaging over the last 4 weeks is clear, pass the spending bill and ballooning debt be damned.

The second is economic. The answer is that this is the government’s way out. It is the destruction of purchasing power that allows the government to inflate away the debt, or pay negative returns on its obligations.

To summarize, the government will pay back Americans, foreigners, and investors with dollars worth less, while allowing its contractual obligations (entitlements) to erode.

Your first signpost is nominal growth failing to support real growth (GDP - inflation), which has ended in tears over the last 20 years (2000/01 & 2006/08).

Here’s What to Expect in Parts 2 and 3

We will explore the impacts on debt, the critical sectors of the economy, and commodities. You will hear “fiscal dominance” and “financial repression” often. We will explain what these are and why they matter.

In this AiQ piece on seasonality, human behavior, and outcomes, we referenced an excellent paper that delves into how inflation’s economic impact can be quantified as ‘outcome-oriented’ events. It’s not about why inflation happened, only that it does and continues.

The secret is this. The cause of inflation doesn’t matter because human behavior does not change. People’s reactions to inflation, whether caused by a war or their own central bank, are to pull forward decisions, reduce investment, and hedge against further debasement. This is what happens every single time.

Specific to commodities, these are a few of the questions we will try to address:

What does purchasing power destruction mean to production margins?

Will inflation be a tailwind for commodity prices?

How will companies behave to try to profit from inflation?

What can inflationary economies teach us about how farmers and small business owners manage inflation?

Can I speculate to get ahead or compensate?

What could stop the inflation-dollar destruction train?

If you have any questions, please share them, and we will include those.

If your reaction is to let your politics affect your thinking, it’s important to remember that macro policy is not up to us. Republicans and Democrats resort to inflationary policies to manage the mounting debt — everything from the debt ceiling fights to America’s GDP reliance on the next fiscal stimulus. This is out of our control.

Thank you for reading. Please reach out to Nico@archaiq.ai with any suggestions on how to improve our products or if you're interested in exploring new opportunities with ArchaiQ. Sign up for our free weekly newsletter at www.archaiq.ai.

This is not trading or investment advice. Trading Futures is a high-risk activity; please consult with a professional.