Becoming Argentina: Can Trump's "Wealth Effect" Save Us from the Crocodile?

He is the it and it is him—This Is Where We Are in on the Road to Central Planning

MAGA needs belief as much as policy—faith in a reborn American dream slipping daily from farmers, steelworkers, and all Christians alike.

Technocratic power of Washinton and Silicon Valley consolidates. A decade ago, technology was the holy grail; today, it is AI. The power grab grows.

What was framed as economic renewal—balanced tariffs, job creation, deregulation, and energy independence—has now quietly been replaced by one core objective: nominal growth at any cost to fuel the wealth effect.

The administration’s unspoken strategy is to inflate perceived wealth—fueling risk-heavy behavior across markets, gambling apps, and digital hustles—an economy epitomized by OnlyFans and Robinhood.

The dollar weakens, trade “victories” are symbolic, and official stats mask deeper decay. The result is rising prices, lagging real assets, and slow, then rapid erosion of purchasing power.

The weak dollar starts to solve trade imbalances, and lower interest rates reduce Washington payments while raising disposable debt-to-income ratios—delivering Trump top-line victories while feeding the crocodile: the ultimate catch-22.

The crocodile—systemic inflation, destruction of your quality of life—feeds from the bottom up, indifferent to belief or politics.

Crocodile Tears—And Real Ones

The crocodile metaphor comes from the book When a Crocodile Eats the Sun. I cannot do justice to the raw human emotion of a society being devoured.

When a Crocodile Eats the Sun is a stirring memoir of the disintegration of a family set against the collapse of a country. But it is also a vivid portrait of the profound strength of the human spirit and the enduring power of love.

I cry crocodile tears because I know Trump’s policies will help Argentina. They’ll lift the business we’re building. They’re a tailwind for AgriAmericas Group, no question.

But I cry real tears for what is lost because home feels so far away now.

Home was the 1990s. When kids could play until dusk, dream without limits, and believe that hard work and saving were enough. That version of America, solid, decent, always hopeful, lives in memory and print.

Trump’s crocodile promises won’t bring that world back. They feast on the promise of hope, offering elusive wealth to save the lucky few. Trump’s siren songs walk us step by step into the mouth of the beast. And that’s why the tears are real.

I Was Elected 3 Times (The Crowd Roars)

I was born and raised in the heart of MAGA country. I know the mindset—not as an outsider judging from a distance, but from within. Friends and family I care about still believe in this government, or rather, in Trump’s words of what government will provide for them.

The collective amnesia—past lies, endless wars, and jobs shipped abroad—is all swept aside. Trump gets me. Trump’s different. He says things that make me feel good. I know I should not trust him, but I need to believe because no one else is looking out for me.

It reminds me of the woman who returns the same man for the third time. She knows he’s probably not any different from before. She even admits as much to her friends, “You think I don’t know who he is?” That little bit of honesty is the human coping mechanism. It’s a hedge—an emotional hedge, like someone staying in a relationship they know is toxic but still needs to believe in. Being alone is terrifying. How will I pay for things?

But what they don’t see—or refuse to see—is that the policies they cheer for are a trap. Deficit spending to juice already inflated financial markets. Deals for the sake of personal legacy. Tax cuts tilted to the wealthy. Reality show theatrics on the biggest stage of all. All while being told it’s Europeans, Canadians, Chinese, and Democrats to blame. I know this does not make any sense, but I trust him.

Trump’s production is reaching its crescendo. The lights are blinding, the music swells, and his crowds roar. The promised Golden Era is upon us.

I can see it happening as if to reach out and touch it—sending a shockwave from my fingertips to my toes. It’s better than a glass of wine mixed with painkillers or the intoxicating first hit from a pipe. I won’t have to worry anymore. The stress dissipates.

As I hover, I suddenly notice the excitement slipping away. The euphoria becomes thirst. I need more. His triumph of China, the roaring economy, and the local high-paying jobs seem just as far as when he began talking about them 10 years ago. Why are my costs still rising?

These are objective truths of Trump 1.0. Trump printed the most money in the history of the country. Government money creation = inflation. Trump was one of many who forced vaccines, enabled the ballooning trade deficit with the EU (big Pharma), and caused inflation. The firefighter is the arsonist. He is it and it is him.

I am confused. I start to think about the things I can touch, things I know are real.

Prices haven’t fallen. My tax savings and childcare credits won’t cover six months of additional costs. Smart people, the ones who used to laugh about his crazy statements, are now whispering about the debt. My house, once a quick sell in a red-hot market, now sits waiting. The market has thrown me around like a skiff in a tempest, and where were my bonds? Useless. I clawed my way back to even, but even doesn’t feel stable anymore.

Something’s off. There’s a tingle at the base of my neck that won’t go away—the feeling of dread I can’t ignore. I need to make more money, I need to get ahead. Standing still is falling behind.

I can tell it’s all wrong, but I need to believe. The Democrats were so much worse…

The Crocodile Doesn’t Care About the Narrative

The crocodile doesn’t strike all at once. First, it bites the poor, the immigrant, the disabled vet. The people no one is looking out for. Then it comes for the working class, for those just barely hanging on. Eventually, it comes for anyone who slips—anyone who hesitates, anyone who falls behind.

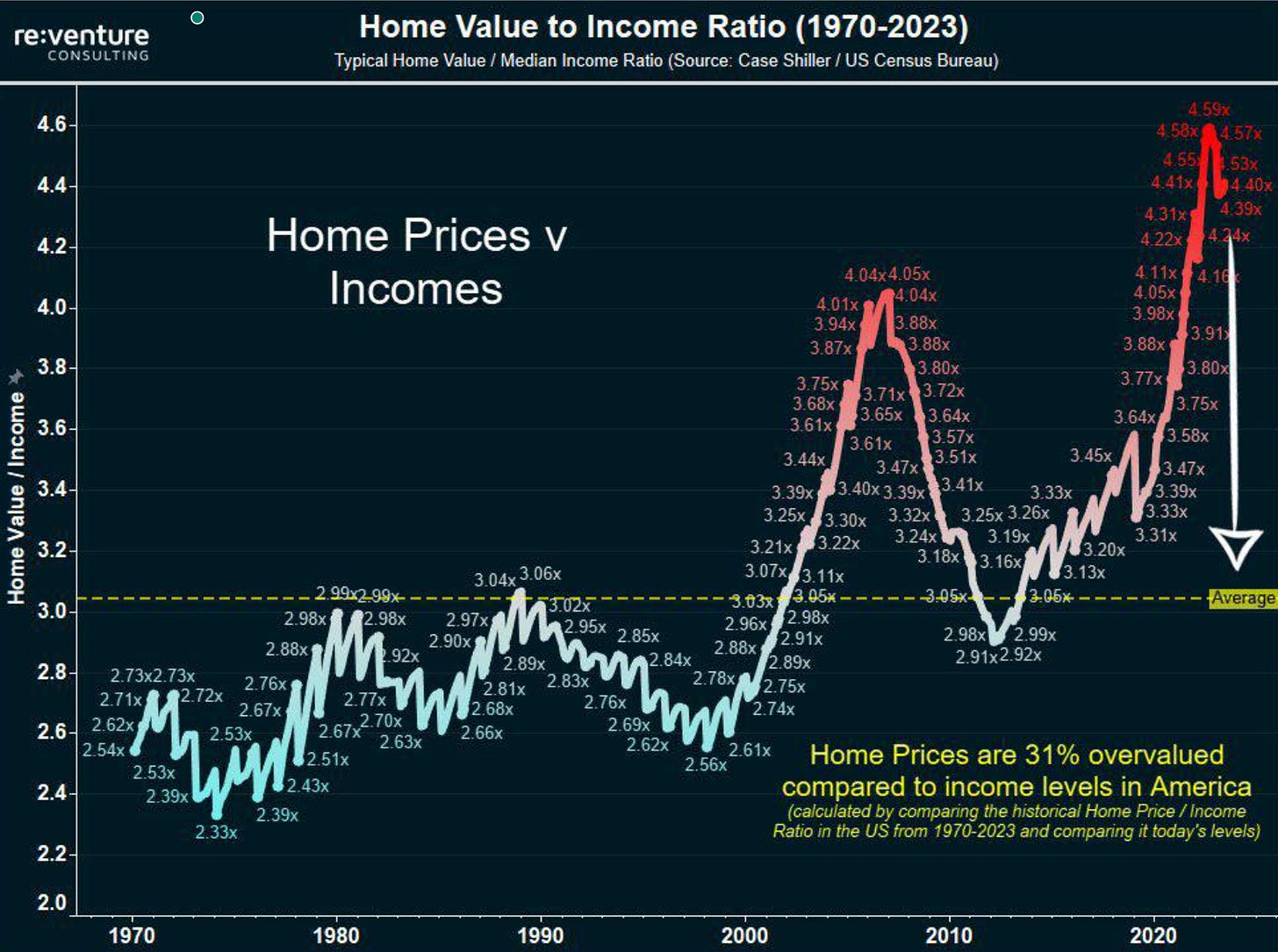

That crocodile is inflation. It’s the slow bleed of your purchasing power. It’s your kids growing up knowing they’ll never own a home like you did—not because they’re lazy, but because the crocodile has taken hold.

It’s important to remember—when you and your buddy are running from the bear, you don’t need to outrun the bear… just your buddy. "No hard feelings, man. Survival’s survival."

Japan, the world’s playground for easy-money debt, is showing the first cracks in the endless balance sheet expansion facade. The proverbial bill is finally coming due.

The richest man in the world threw in the towel, following a blitzkrieg of propaganda and next to no savings. I was against DOGE from the beginning because this is not how you fix institutions, nor the government. Argentina gave you the roadmap, and you chose reality TV and propaganda.

So now what?

Change the narrative. It is all about growth now. The goal posts are moving so fast, no one will remember where they were—shift them again. The Democrats, Europeans, and Chinese are the bad guys. Redirect, deflect, dip, dive, dodge.

If anyone can spin this, Trump can. Now it’s about growth and tariffs for revenue. We were ripped off. Nippon Steel. Make the announcement. 40,000 jobs? Make it 70,000. A trillion dollars of unrealistic investment from Saudi Arabia? Make it 1.2 trillion.

My Head is Spinning, Let’s Take a Step Back

What exactly is the crocodile?

Many of our investors are wealthy. By contrast, my friends and family growing up were not. Discussing wealth in America is difficult because everyone claims to have grown up poor. A hundred million Victorias…

The crocodile doesn’t care if you grew up poor or know poor people; it cares if you can protect yourself. It cares about your level of vulnerability and reliance on the safety nets.

Even within the lower and middle classes, there is a politically charged cynicism toward government employees, driven by political narratives—”lazy LiBeRaLs aaaarrrggghhhh.”

Ironically, many who express such disdain are themselves reliant on the same underfunded public systems—Social Security, Medicare, Medicaid, veterans’ benefits—for future financial security.

It is critical to recognize that economic forces such as inflation do not discriminate by political ideology. The structural imbalances America faces—such as underfunded public obligations and mounting debt—are ultimately felt first by society’s most vulnerable: the poor, the marginalized, and the disabled. However, this is not where the impact ends. Like a persistent predator, inflation moves methodically—once the lower rungs are exhausted, it shifts upward. The middle class, and eventually even those who once felt insulated, will find themselves exposed. The process is indiscriminate and unrelenting.

This is where the metaphor gets even more fitting. When wild crocodiles grow to a certain size in Africa, there is a good chance they are man-eaters for two reasons: man is the easiest prey, and a 1,500-ton croc needs a lot of sustenance.

It’s the same reason big-game hunters shoot the largest crocodiles. Once they grow big enough, they consume whatever is near. Conversely, monster crocs become more skittish and harder to kill. Are we getting the metaphor yet?

This is an amazing book recommended to me by my mentor. It is the book I gift most often. How little we know about these beasts and the ecosystem is humbling. The only path for success is if the local Africans and the environmentalists work together; otherwise, the system is doomed. Sound familiar?

America has no shortage of wealth—natural resources, human capital, or industrial might. If it fails to feed, house, or care for its people, it’s not due to scarcity but choice—to prioritize capital over community, shareholders over citizens. It’s the quiet decision to deploy resources upward rather than outward, all while masking neglect as necessity.

Trump’s promise to reverse the direction of America is advertised as cheap energy, lower rates, lower taxes, and foreign capital investment. Supporters see this as a path to revival, even if it requires a strong man to implement top-down change. This obviously runs counter to America’s bottom-up foundation: frontier mentality, self-reliant communities, and distinct identities.

In reality, there is almost zero chance this will work, and after only four months, the administration is falling back into the same trap as 2020, pinning their hopes on a massive wealth effect.

There are two reasons this approach is doomed.

First, it’s not America or American.

Second, it will only feed the crocodile.

This approach is doomed, but it appeals perfectly to Trump’s autocratic tendencies—the burden of always knowing best.

Before we move on, let’s consider the top-down societies that Trump is so fond of: Saudi Arabia, Russia, or Turkey—to name a few. Societies that are built unequally, requiring strong men at the top.

When Someone recently brought up Trump’s similarities to Silvio Berlusconi, I could not unsee it.

MAGA: Nico, this is outrageous. Trump is working for free for Americans.

Nico: Okay, dummy, who do we send the birthday bill to?

This is who Trump is. I heard this two weeks ago from a credible source. Trump wanted access to towers, beachside resorts, and golf clubs. Starlink would need to be included. The Vietnamese were speechless; they thought they were there to negotiate on behalf of the countries. The starting point for the US was Trump and Musk’s personal interests. This was released. The crocodile feasts on corruption.

What is the Wealth Effect?

Mainstream economics describes the wealth effect as

the tendency for individuals to increase their spending when the value of their assets rises, even if their income hasn't changed. This behavioral response is based on the idea that when people feel wealthier—due to rising home values, stock prices, or other financial assets—they become more confident about their financial future and are therefore more willing to consume rather than save.

The post-2020 wealth effect is similar but on steroids and leveraged to the hilt.

Can’t afford a home? No problem. Lever up your last $100, YOLO into Palantir at the moment of Alex Karp’s shadiest comment, then roll half into QQQ (ODTE) options, but queue off a Trump tweet for timing. Put the other half on a Yankees-Scottie Scheffler-Journalism-Caitlin Clark 900 to 1 parlay.

Amazingly, you are up $225,000 but aren’t qualified for a mortgage. Going to need to YOLO that once more into one of Eric Trump’s shitcoin tips.

Don’t worry about it, you are right back where you started, only with a little more Klarna debt from all the DoorDash deliveries.

Are you starting to get the idea yet?

Let’s Talk About Trump’s Actual Policies

Trump advocates for:

Lower SOFR rates, Powell needs to get them down ASAP

Tax reductions for all Americans (Big Beautiful

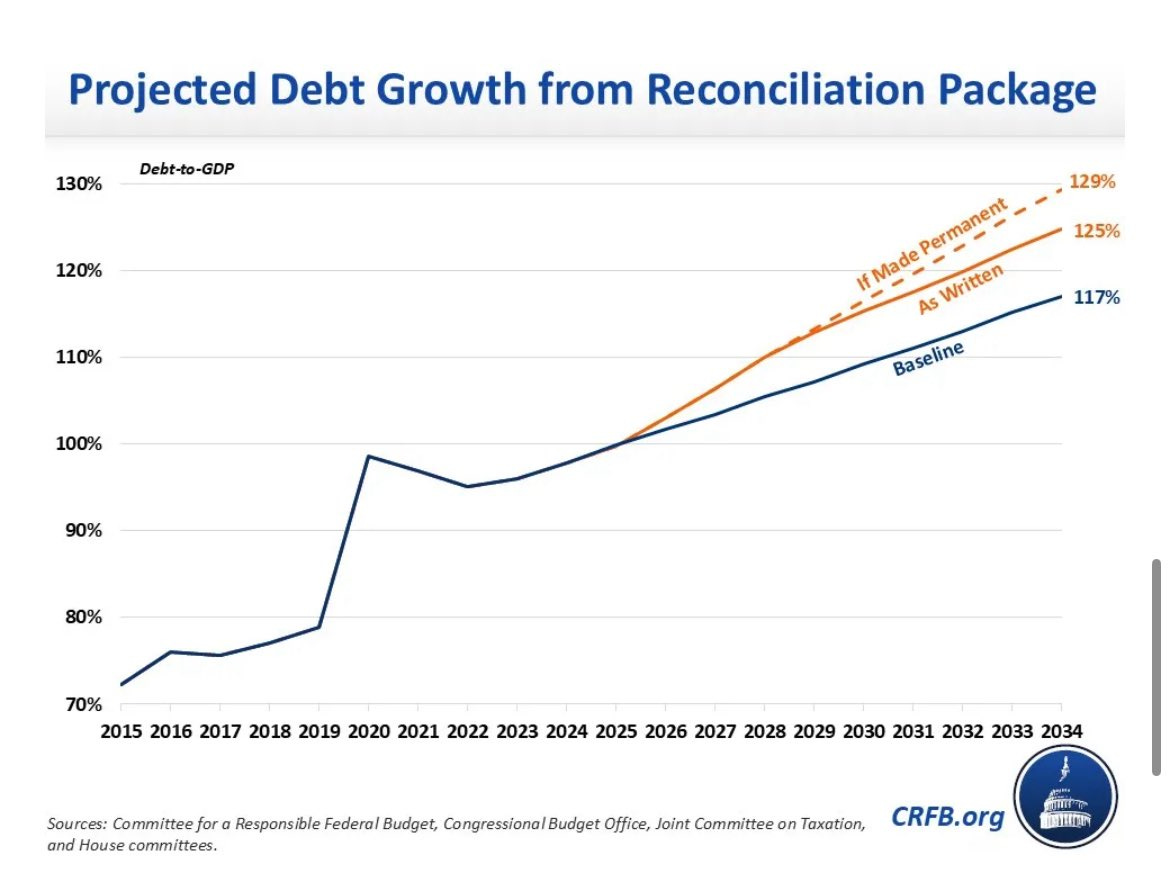

Debt BombTax Bill)Growth that can outpace the ballooning deficit (Bessent’s latest admission)

A higher stock market (daily tweets)

Foreigners to eat tariff costs to offset tax revenue losses, so Americans can still consume more (explicit tweets)

Unregulated crypto speculation (bribery and laundering are a cost of doing business, F.C.P.A. is the same theme)

Cheaper mortgages, risk management and 2008 be damned (HUD bills, lower long bonds)

US companies to eat the rest of the tariff costs and lower prices, but preserve record profit margins, because we need stocks to be higher (Apple & WalMart tweets)

The first-ever $1 trillion military budget (YAAAASSSSSSSS)

Deregulate by decree with no coherent plan or buy-in. Coal. Yes. Nuclear. Sure. Solar. GET THE F&%$ OUT OF HERE. Wind. Yes, but it’s a horse trade. (Trump U-Turns on $5 B New York Natural Gas and Wind Deals)

What this agenda will do for certain. Goose the ever-living-shit out of markets. Let’s refer to it as GoE (goosing-of-everything). MAGA’s new #1 priority to ensure nominal growth above all else.

It is an agenda that the crocodile will come to feast on.

We Have to Start with Housing

The housing market will get tricky. Inflation is theoretically good for home prices, but affordability issues could become the #1 ballot item in local and state elections beginning next year.

America’s housing market is roughly $40-45 trillion vs $15 trillion in China, and a population 25% the size. China’s housing market pain has led to deflation across the economy, and household savings have exploded higher.

By mid-2026, housing will be a major focus for the Trump administration because they will have no choice. This will be an positive untinended consequence of the GoE. How they navigate this may end up being a function of mortgages getting to the point where the government has to backstop more loans.

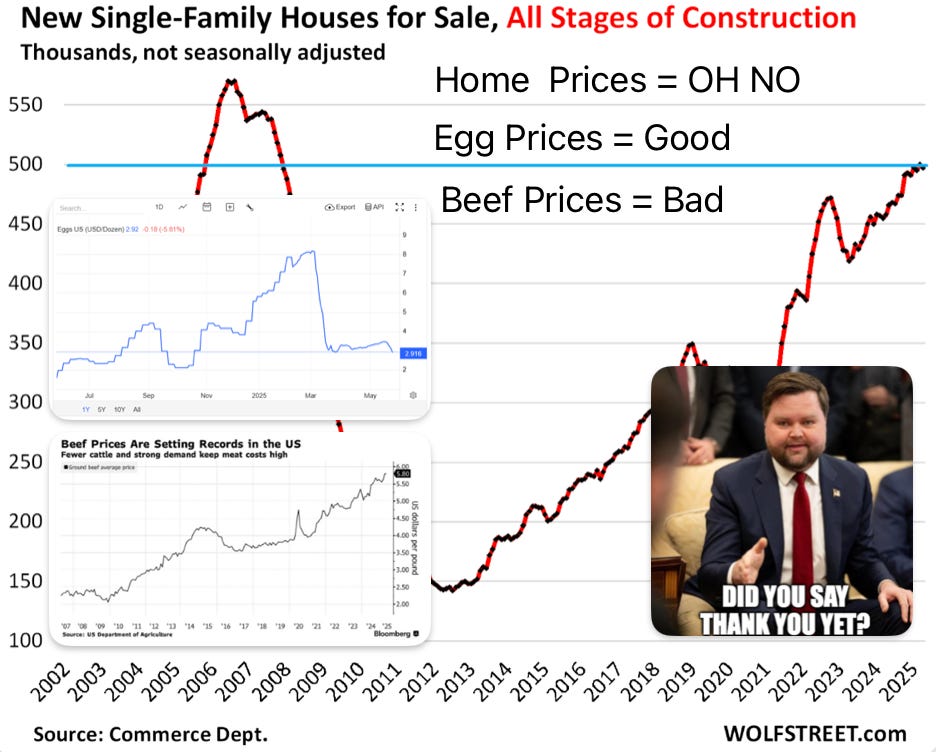

The crocodile can be slowed if constructive policies are implemented, but the challenge is that they are often in stark contrast to how the administration views wins. Building more homes is a critical ingredient, but this takes time. Any taming of inflation in home prices is good for Americans, but bad for the GoE. Trump celebrates lower egg prices. Trump does not talk about higher beef prices.

Trump Math is the Simplest Math in the World.

Anything positive is because of Trump.

Anything bad is because of Biden.

Got it?

If it were only homes.

In Scotty We Trust — We Thought

Scotty’s transition to growth serves dual purposes. First, it obfuscates the failure of DOGE and any discipline the Republican party would dare impose on Trump’s agenda. If you are against Trump, you are against growth. It is utter bullshit, but it’s clever. It gets the administration back on the offensive.

Second, it’s all about nominal growth, not real wages and costs. Every action that contributes to nominal growth overshadows its impact on inflation. “We said tariffs would bring back jobs, and we delivered. There will be 70,000 jobs in Pennsylvania and 20,000 in Michigan. These beautiful tariffs have added .4% of GDP.” The MAGA crowd shrieks enthusiastically.

If tariffs contributed 1% to inflation (a reasonable assumption), it’s a net loss for America, but a win for Trump's talking points. It’s a bigger win for the crocodile.

If anyone is brave enough to point out this dichotomy, they will get uninvited to the influencer press conferences and rebuked as #fakenews. Even though it’s 100% true and the crocodile LOVES IT.

Don’t panic, there are corrupt other ways to get access to Trump.

Corruption Enhances the Wealth Effect

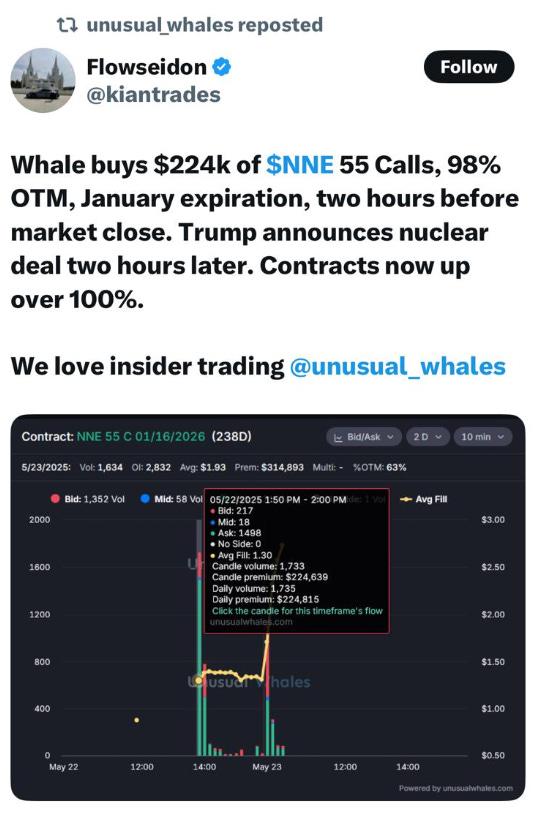

If you want people to get rich, take away the rules. We saw this in the 1920s, and we are doing it again. Part of the Mango ruling was not about the illegal behavior, but about the onus on the issuer to safeguard. In effect, $110 million was stolen and no one goes to jail-America, Fuck Yeah!

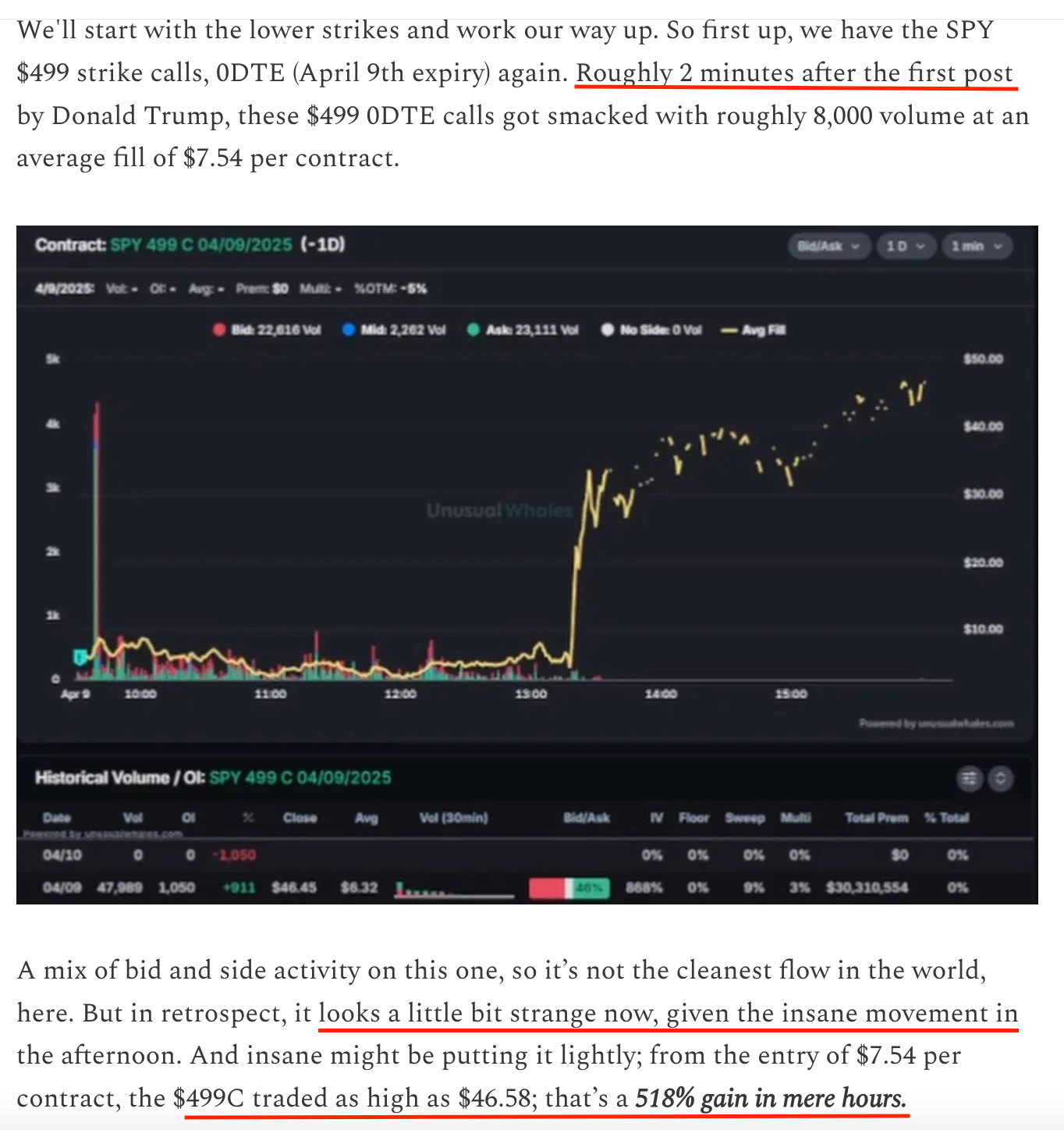

Here are examples of shady trades taking place around Trump announcements. The PELOSI Bill eliminates representatives’ abilities to profit from inside information. Americans from both parties are behind. Yet, the Trump administration says, “Hold my beer” while the evidence shows someone(s) KNOWS his next impulsive tweet.

The crocodile loves a society without regulations and rules, so many too fail and fall through the cracks.

Financial Repression Are the Croc’s Favorite Words

This administration wants lower interest rates, especially at the long end of the curve. They are not going to get this without severe financial repression. Financial repression is a term you are going to hear a lot.

Financial repression is a set of government policies that artificially suppress interest rates and redirect capital to the state, often to reduce public debt. This is typically done by:

Capping interest rates below inflation

Forcing banks to hold government bonds

Limiting capital flows or alternative investments

The effect: savers lose purchasing power, while governments inflate away debt more easily. It's a hidden tax on savings used to stabilize public finances.

Trump and Scotty thought they could manipulate rates lower post-Liberation Day. The new phraseology goes “never let a crisis you create go to waste.”

The bond market did not like this “too clever by half” behavior. Rates have been moving higher, led by the bonds (30-Year). Higher rates will raise borrowing costs (7% mortgages last week), but a steeper curve could encourage foreigners to absorb longer-dated securities. There will be a lot of demand between 5.5% and 6%.

Yet, if the bond market forces yields there because of Trump’s profligacy, then this could prove short-lived, and direct financial repression is coming much sooner.

Either way, the admin finds itself in a tricky spot and will look for two options: how to kick the can to 2028, and what tools for light-touch financial repression are available?

Music to the crocodile’s ears.

Do Crocodiles have ears? The stuff I find myself learning about late on Saturday night.

Yes, crocodiles do have ears—and quite good ones.

Their ears are located just behind their eyes, covered by a flap of skin that closes to keep water out when submerged. Despite having no external ear structures like mammals, crocodiles have excellent hearing and can detect both airborne and underwater sounds.

This acute sense of hearing helps them:

Detect prey (even when hidden or in distress)

Communicate with each other through growls, hisses, and bellows

Respond to hatchling calls from inside eggs or nests

So yes—crocodiles hear, and they listen.

Scotty Was in Argentina, Learned “Nunca”

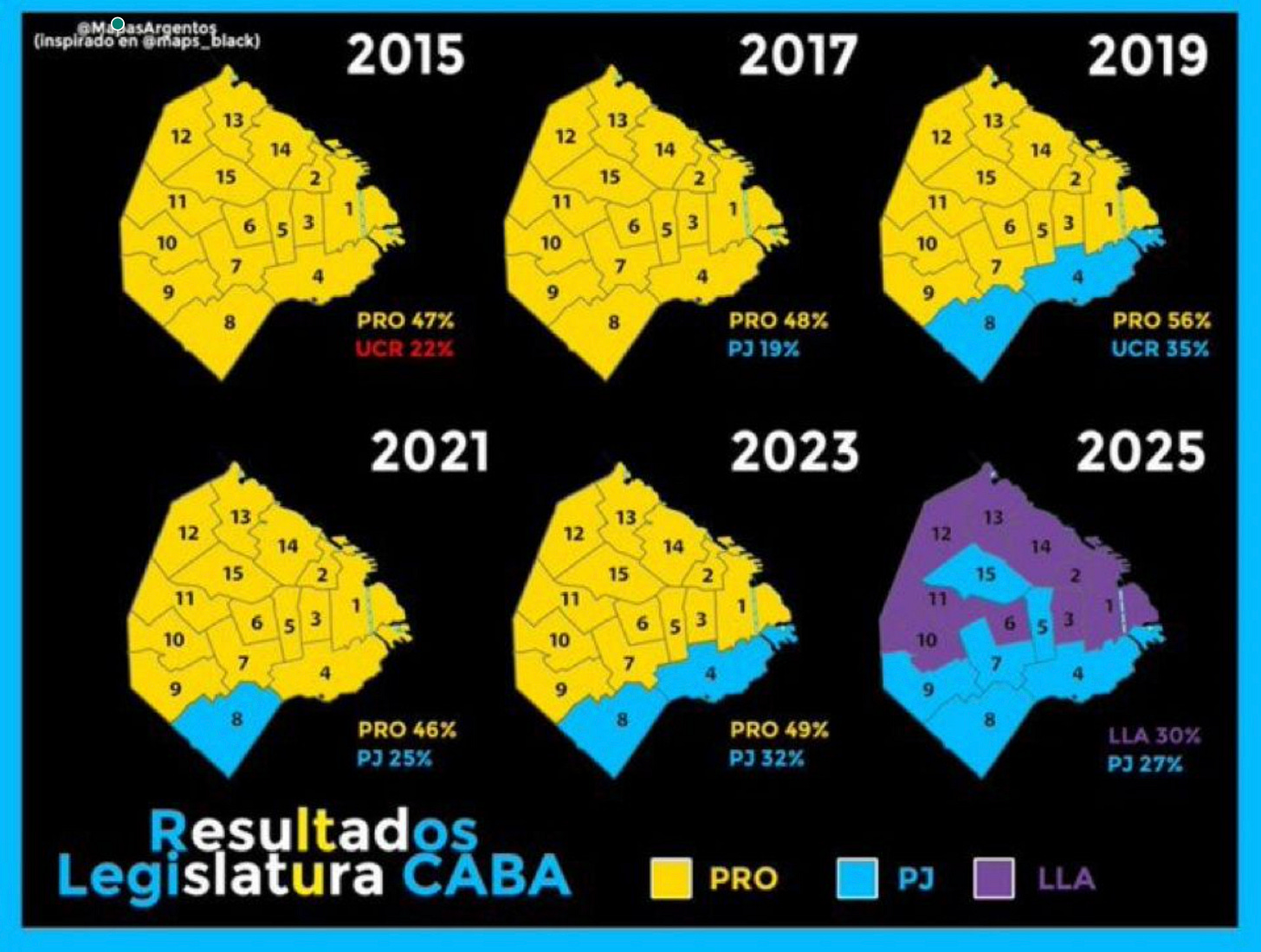

If Scotty knew anything about Argentina, he would have to know that this toxic faux-economic brew they propose is the polar opposite of Argentina, confirmed by last week’s Buenos Aires elections (CABA).

Here is a quick recap of Javier Milei's three steps to turn the country around.

Tame the inflation crocodile at all costs

Decimate government spending and waste

Force growth INTO the private sector

Milei curtailed government spending by 4% of GDP and will achieve 5% growth, effectively pushing 9% into the private sector by taking the pain upfront.

The chart below shows how Milei has been rewarded. LLA (Milei’s party) +18% in one year, PRO -22%.

There. That’s it. All the other sleight of hand narrative swapping, spending cuts to growth projections, are to fuel the wealth effect.

While we tried to give Scotty the benefit of the doubt, it proved naive.

I got critical of Bessent quickly, and this view is gaining traction. He is credentialed, wealthy, and carries an imposing stature. We want to believe someone in this White House can steer the economic ship.

MAGA supporters will argue Scotty is in an impossible situation—few options as Trump’s impulses outweigh economic reasoning. It’s entirely beside the point.

Growth at all costs is not a sustainable policy. The US cannot outgrow China in the next decade, and the consequences of trying through deficit spending will be severe.

Why? Has Scotty’s position quietly shifted so rapidly? The government expenditures and real GDP are heavily intertwined, especially after Trump and Biden’s money-printing-fiscal-palooza of 2020-2024.

Scotty’s 3-3-3 was murdered in the first 3 months of Trump’s term. It is replaced with the “nominal growth at all costs” dictum. Discipline of any form and buy-in from the private sector no longer have a place in Trump 2.0. It is the new whatever-it-takes nominal growth model.

Or he could be full of shit. There is always that. Again, the crocodile does not care “why.”

You don’t say Jared, you don’t say…

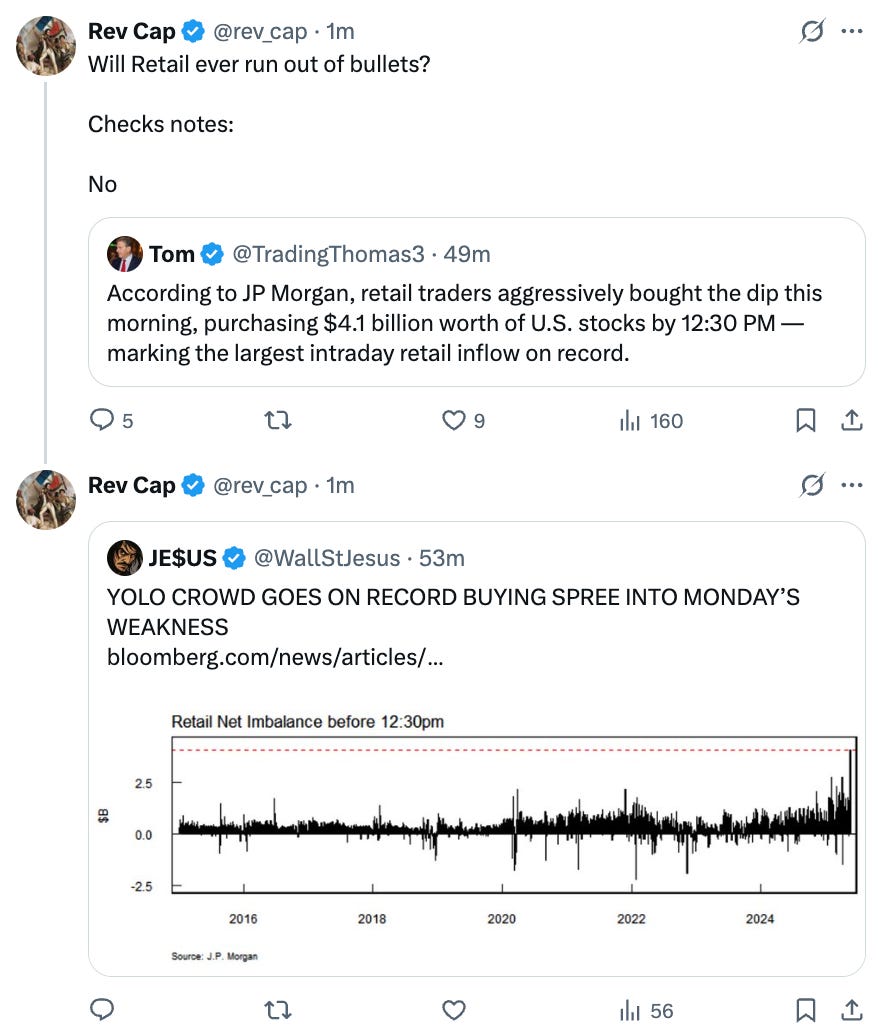

Retail Will Not Stop Until There is a Reckoning

A normal day for YOLO punters in the Post-COVID Crocodile marketplace. Do you see how the bars on the bottom chart keep getting bigger? That is NOT a sustainable trend.

As of April, one in every fourteen option trades in America now expires the same day it's placed. That should get your attention.

In its purest form, an option is a precision instrument—a scalpel or a diamond knife. It's not a butcher’s blade. The equity itself is the day-to-day tool: if you believe in a stock, you buy the stock. Simple. No confusion.

Options exist to amplify exposure—to add leverage, or embed time. There is a volatility component, but it’s not applicable to this conversation due to transaction costs for retail and volume required to delta hedge effectively.

But zero-day options strip time out of the equation entirely. What you’re left with is pure leverage. These are not investments. They’re intra-day speculation on steroids. It's not risk management. It's adrenaline trading, and it’s become the latest get-rich-quick scheme in equity markets.

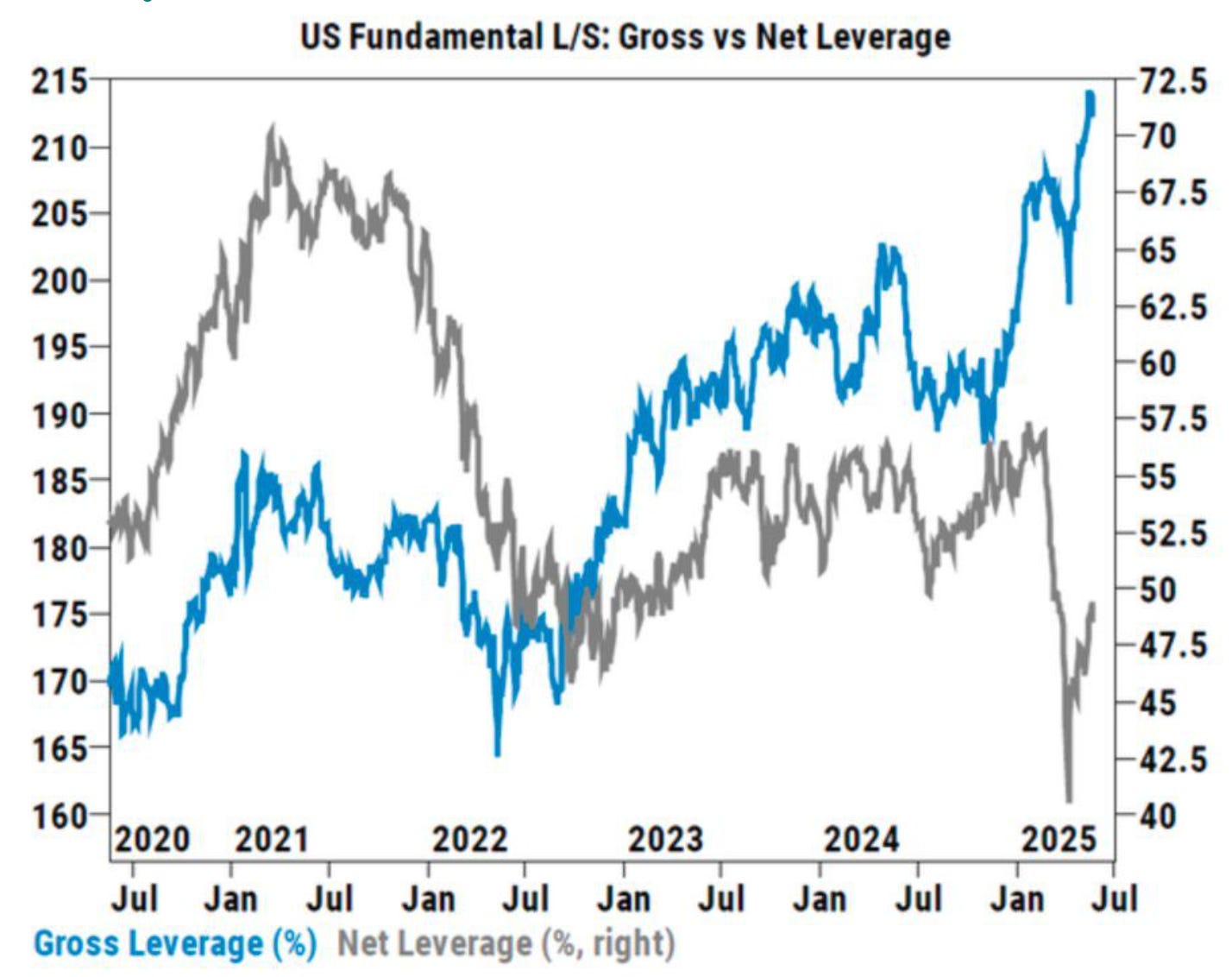

This is not only a retail phenomenon. Hedge fund gross exposure climbs to new records each month, and the administration’s policies aim to enable balance sheet expansion.

There is a debate over the function of relaxing the SLR. One camp suggests it is the ability of banks to take down more treasury issuance (a hot topic right now), the other contends that this is moot. It’s a function of reduced capital requirements, enabling more buybacks and “risk taking.” This will eventually lead to the repeal of Dodd-Frank (the constraining rules)—the real culprit limiting banks’ balance sheet capacity.

Hold On, Nico, There Are Reasonable People in the Republican Party

Absolutely, and as soon as they let it be known, they become an enemy of this state. They can choose relative obscurity (Rand Paul) as Trump’s new influencer-propaganda core dismisses them, or become enemies of the administration.

Here is a rational spending argument made by Senator Johnson. In the 1990s or early 2010s, responsible discussions were common. In 2025, this puts you in Trump’s crosshairs. Does it mean anything is going to change? Of course not, but it dispels the notion that MAGA is about the Republic or Democracy.

"Instead, we have the worst of both worlds. Congress is afraid to go against the President’s wish list, and can be held hostage by a handful of House members representing special interests. The budget becomes the GOP version of an everything bagel."-Scott Sumner

A discussion every parent in America should want to have. How can we avoid burdening future generations with crushing debt? It is the one conversation Trump will not allow.

We ended up with the House passing an atrocious tax bill to provide further fiscal stimulus to ensure the Wealth Effect wins again!

In the long run, America’s youth and poor lose again. But hey, what else is new?

Wrap up: Why Keep Feeding the Crocodile, If We Know How It Ends

There are a few plausible arguments. The most common justification from MAGA supporters is that there is a chance it will succeed. Scott Sumner explains it better than I can.

"One thing I’ve noticed during the nearly 50 years I’ve been a macroeconomist is that stuff happens. I don’t know what will happen, and I don’t know when it will happen... Our budget situation is not even sustainable if nothing bad happens going forward. I suppose it’s possible that some sort of AI miracle will rescue us, just as its theoretically possible for someone drunk and high on cocaine to put on a blindfold and drive 90 mph down the highway without hitting another car."

Another reason is every elected official loves deficit spending when they come to power—and even more when they leave power. I am not a Democrat and do not support years of virtue signaling/gaslighting, border negligence (worse?), and false empathy for entire classes of citizens left further behind.

My Opinion Is AI, But Not Why You Assume

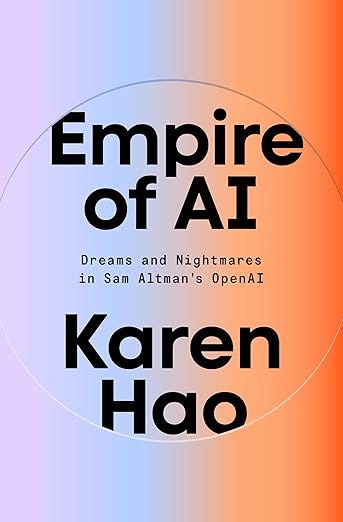

The reason I find most compelling is the arguments around AI. Not the growth prospects, but the outcomes.

Consensus is forming that social media is bad for us. The tech titans know, parents know it, and societies are pushing back. The race for AI is all that matters now.

Billion-dollar data centers driving up utilities—cost of business. AGI posing existential risks to humans—deal with it later. Too much power in a few hands—need to make sure it’s my hands. This is why they all sit together in this photo at Trump’s inauguration. The only person who can guarantee a seat at the table is Trump. The tech oligarchs do what they must to ensure unfettered access.

Here is an anecdote demonstrating the speed and magnitude of change.

It took Mark Zuckerberg years to approve the “Like” button.

People forget that. The hesitation wasn’t technical—it was philosophical. The concern at Facebook was that a button would take away from written engagement. I remember this vividly because I was at the University of Chicago when we were among the first dozen schools allowed into this new “elite social network.” Back then, Facebook was intimate, curated, and a little academic.

Why does this matter? Because Mark, later Jack, and the rest of today’s social media technocrats were figuring it out as they went.

Fast forward to 2015: Sam Altman invites Elon Musk to dinner—not just to network, but to impress talent he needed to join him. At that moment, Sam had his sights set on an AI dream team. Elon was the golden ticket. Ilya Sutskever and others would at least take his offer seriously if Elon were in the room. Sam, one of the modern era’s great storytellers, often strays as far from the truth as needed to make his vision yours. Elon got what he wanted, too: a front-row seat—and a path to ownership of an AI technology that could one day challenge Google’s dominance.

Three years later, the façade of altruism had collapsed. The non-profit illusion gone. Sam had his own grand designs, and Elon doesn’t share power. Microsoft entered the picture with billions of dollars and one of the world’s largest data sets. The new world was here, and it wasn’t built on caution or open-source dreams—it was built on speed, scale, and capital.

From ChatGPT:

Welcome to the Empire of AI

And that brings us to 2025:

We’re in an economy held together by illusions. The debt is mounting. The dollar erodes—not so quietly anymore. The wealth effect holds it all together. People feel just rich enough not to panic, but they must run faster.

There is only one solution; it is simple and brutal. Make more money. That’s your answer. That’s your lifeline.

Can’t make more? Fine—here’s a nickel of tax relief and a Social Media ad promising passive income by Friday. Good luck. Just keep running. Because the crocodile is coming for you next, and it doesn’t care about your sob story or voting preferences.

A Few Signposts for Trump’s GoE Success

Below is a list of stocks that reflect where we are in the GoE timeline. Stocks are the most liquid and easy to monitor. Here is a list of other markets to watch.

Sports betting and online gambling.

OnlyFans creators and revenue. Eventually, there will be the political will to ban such a horrific industry.

Bitcoin (but this may be problematic as it has a function to reflect the fiscal largesse).

#TRUMP is a great shitcoin indicator as the value will depend on his influence more than the crypto space.

Calls for regulation in financial markets. Trump will deregulate first, but they are going too far, too fast. This is the ultimate pendulum.

The oncoming blue wave in 2026 mid-terms. Will Trump be a lame duck before August 2026?

How aggressively Trump’s new Fed Chair eases monetary policy and the impact on bonds—lead up to Feb/Mar 2026.

A Multimillionaire’s Response: “I Don’t Get MAGA”

I was tempted to respond, but realized the very notion that those who will be eaten last, mocking and chastising the very people who built this country, served this country, and who will be sacrificed first, is exactly where we are in the cycle.

This isn’t about politics. This is about decency, about truth, about survival. Let’s be clear: MAGA is not a movement to fix anything. It’s a branding exercise—one that preys on frustration, rewrites history, and offers nothing but hollow slogans while the foundations of America crack beneath us.

Trump is not Making America Great Again. Trump is Trump. Trump is self-enrichment. Slogans without substance. Leveraging my kids’ future for his legacy. He is it and it is him.

Trump’s MAGA is the next iteration of Socialism and Central Planning in America. It simply does not wear the name Biden or Kamala for the next 4 years.

I will leave you with this…