AiQ's Weather Alert: Bullish Outlook Gets a European Tailwind — June 18, 2025

Is Reuters the new contrarian indicator?

“Everything that happens once can never happen again. Everything that happens twice will surely happen again.”

-The Alchemist

This quote reminds me of how weather markets happen. Three to four times a year, there’s potential for a major weather-driven disruption. Yet the patterns that get hyped—blistering heat waves trapped by ridges or droughts forecasted months in advance—rarely unfold as advertised. Forecasters who call for catastrophe each year will always find a reason to do so again the next. It becomes less about the data and more about confirming a story they’ve already decided to tell. There are countless models to choose from each day—the latest AI model is why this time is for real. Their biases are expensive, and they are doomed to repeat as long as customers pay the consequences.

Everything that happens twice will surely happen again.

But for those of us who approach each season with objectivity, every weather market is a blank slate. No two are the same—not the markets, not the catalysts, not the weather. The initial rally may come from a freak drought, a geopolitical shock, or a misread trade policy—none of it is as expected. When we let the data guide us rather than force it to support our pre-existing biases, we begin to see weather for what it is: uncertain, nuanced, and always similar, but never the same.

Every weather market that happens once can never happen again.

AiQ’s May Newsletter cited soybeans as the commodity to watch, with solid price support due to ongoing planting risks and poor production economics. This is the driver in late May, not an arbitrary carry-out or long-range forecast guesses. There were other indicators, which you can review at your convenience.

Last week, we explained why Israel’s bombing could catalyze rallies in wheat, cotton, and the dollar reversal. All three trades could have been executed with a tight stop, offering excellent risk-reward.

Cotton is down 1%

DXY is up 1%

Wheat has become a face ripper — up 60 cents or 12% since Friday morning.

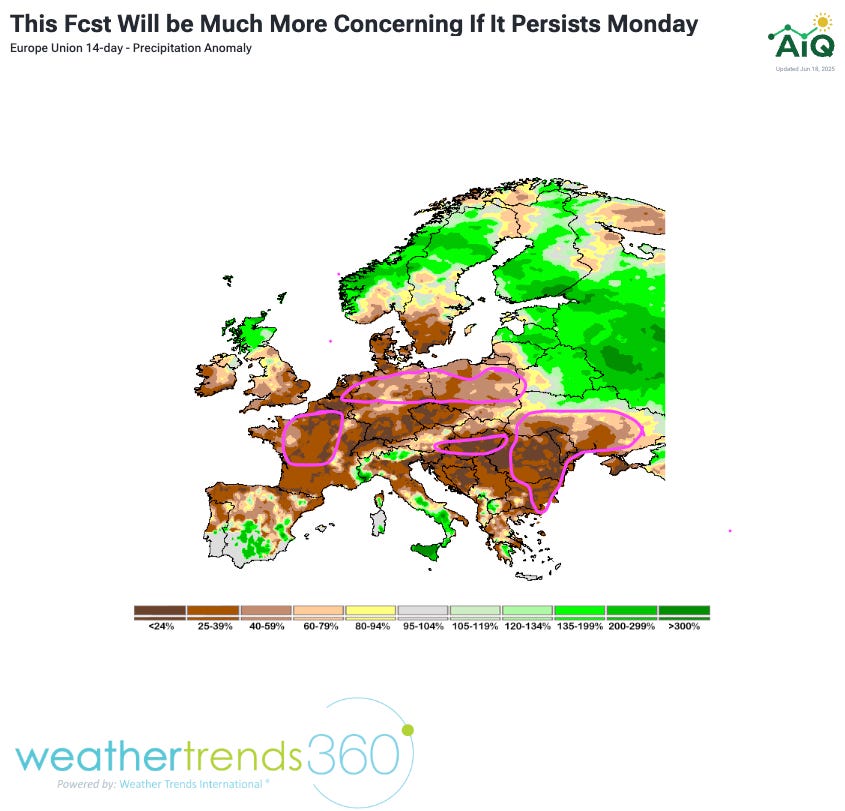

Now, a Drought in Europe Could Catch Traders Short

Here’s an updated look at the latest weather maps, field reports, and where real risks are emerging. While headlines continue to focus on Krasnodar’s “emergency alerts,” the real concern is shifting west—toward Ukraine, Romania, Germany, and potentially Poland.

The situation in France is “heating up” as temps reach into the low triple digits. Here is the latest forecast for the central production areas.

Total EU corn is projected between 62-65 MMT, a potential improvement of 5 M from last year. Romania and Ukraine were expected to make significant rebounds from last year.

Ukraine corn and wheat are a growing risk. The latest forecasts show rains push back into the north and east of the country, but there has been stress all season.

Romania, Bulgaria, and southern Ukraine are all lighter soils along the Black Sea that dry out quickly. This gives way to more variable yield potential than areas of Western Europe.

Hungary and Poland are two of the larger corn production areas that often go overlooked and are facing rapidly growing soil moisture deficits.

France was in better shape two weeks ago, and strong winter crop yields will alleviate some of the risk for a few weeks longer. The heat continues to intensify. Spain is facing a similar issue, and will remain a strong importer in the upcoming campaign. The US and Ukraine were expected to compete for this business.

Here are the Critical Corn States, It’s as Easy as Asking ANDY

Other Comments

Winter Wheat crop tours in Russia suggest Stavropol was better than expected, fields improved 25-50% from a year ago, but it will not be enough to offset Rostov. Yields were estimated at 2 mt/ha or less, versus 3.5 to 4.5 last year.

Early rapeseed yields have been positive across the EU, supporting a crop of 19-19.5 MMT. The winter was mild with average rains in Germany and better than average across central France.

AiQ’s wheat production has been steady at 83-84 million tonnes for the last three months. Russia’s weather has been favorable over the last 8-12 weeks. The sub 81 forecasts were never realistic.

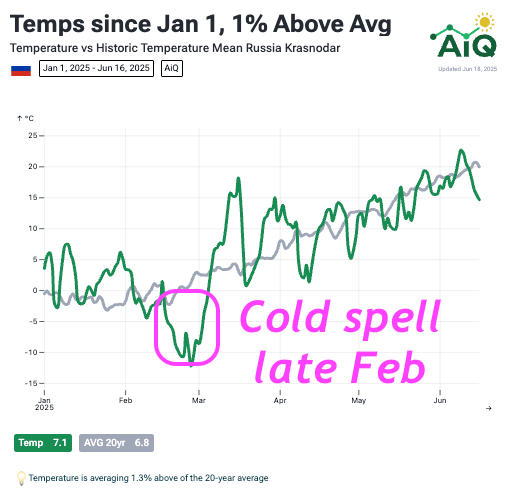

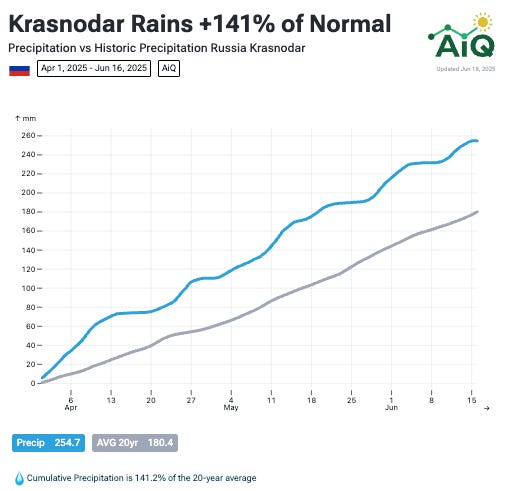

Krasnodar, Russia’s second-largest wheat-producing region, has experienced a highly variable spring. Winter temperatures remained well above normal for most of the season before a sharp cold snap occurred in late February. Since dormancy broke, precipitation levels have generally been above average.

Preliminary harvest reports from neighboring Rostov suggest that yields may come in below expectations—a possibility that could extend to Krasnodar as well. Multiple "state of emergency" declarations have been issued in Russia since last fall, which aligns with the broader pattern of challenging agricultural conditions, not necessarily reflective of extremely poor weather.

Did Reuters Become Agriculture’s Contrarian Indicator?

Keep reading with a 7-day free trial

Subscribe to Nico AiQ to keep reading this post and get 7 days of free access to the full post archives.