Raise Your AiQ: Don't Chase the Wx Narratives. Soybeans Should Have Your Attention.

May 2025 in Review

This month’s note arrives a few days late, with good reason. I spent last week in Argentina, taking a few days to explore the Uco Valley and overcome the latest strain of COVID—this is still a thing apparently.

The photos below were taken during a horseback ride into the Andes southwest of Mendoza, where early winter snows are already blanketing the peaks.

The timing of snow in the mountains and rains across the western provinces has been early this year. Reservoirs in the north have begun to refill, setting the stage for what could be one of the strongest winter crop seasons in recent memory. Nature, it seems, is doing its part to support the local government.

AiQ Adds Some Weather Firepower

Miguel has joined AiQ as an expert contributor, and we are lucky to get access to his experience inside the NOAA machine. Young meteorological experts who want to embrace where the world is heading are difficult to find.

Miguel’s training in meteorology and his interest in big data make him the perfect person to tie traditional NOAA modeling to AiQ’s approach of how weather data guides decisions and prices.

About Miguel. Raised in the Corn Belt, wired for weather. With a decade of forecasting split between the private and government sector, I chase patterns from the mesoscale to seasonal outlooks. I aim to combine my weather expertise with interests in big data and ag.

Can ENSO predict grain yields across the central US? A 2025 Perspective

As of mid-2025, the equatorial Pacific Ocean is under ENSO-neutral conditions, meaning there is no active El Niño or La Niña phase. NOAA projects that these neutral conditions will likely persist through the summer and potentially into the fall, though there remains some chance of La Niña development by year-end.

While other weather groups are guessing what will happen this summer and using that guess to speculate on what prices will do, AiQ delivers statistically significant tools from the original data sources.

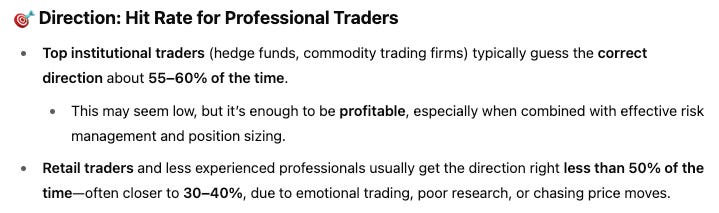

Consider a coin flip, but with worse odds

Effectively, a non-professional trader (let’s say a weatherman) with an opinion on grain prices more than 1 week in advance would fall into the range of less than 50% accuracy on his forecasts and a hit-rate of 40%.

Statistically speaking, his odds of getting price direction right on any single guess are roughly 20%. From my experience, 20% is a fair representation of meteorologists’ predictive powers in agriculture, hence why we started AiQ.

Don’t take my word for it, ask ChatGPT.

May’s note takes a step back to focus more on the macro picture and soybeans. Why? Because much of the market chatter remains fixated on tight global grain stocks—a narrative that’s already tired and largely priced in.

AiQ Axiom: Balance sheets are snapshots in time. If a supply-and-demand story is trending, it’s already priced in the market.

If South American farmers were to make 2025/26 planting decisions today, they would heavily favor corn for full-season crops. Any corn story is about northern hemisphere weather, beginning in mid-June.

Remember, these meteorologists who become crop guessers never explain “what happened.”

AiQ had reduced Safriña's potential due to TOO MUCH rain in February, which was at risk of not getting planted. There were groups out there telling you this was one of the driest starts EVER for Safriña. This is an industry that says, “Trust our guesses.”

Before anyone says, “Well, what had happened was…” Mato Grosso rains reached 173% of the 5-year average (Feb-May), and Sugar just traded a 4-year low as Sao Paulo

Speaking of Argentina, Remember the Floods?

Remember in mid-May when floods in northeast Buenos Aires were projected to cost the crop over 1 MMT? These stories are two days apart. The epicenter of the floods was between 15 and 25 minutes west of CABA by plane. It should not be difficult to avoid sensationalizing these events.

Here are photos flying over Zarate—there’s no standing water in sight.

The Rosario Grain Exchange raised Argentina’s soybean crop estimate by 3 MMT throughout May. AiQ had suggested that maximum losses would reach only around 500kmt, which may prove high. It will be impossible to get an accurate figure for how much damage these floods did, but it will be less than the improved yields in the region from two months prior.

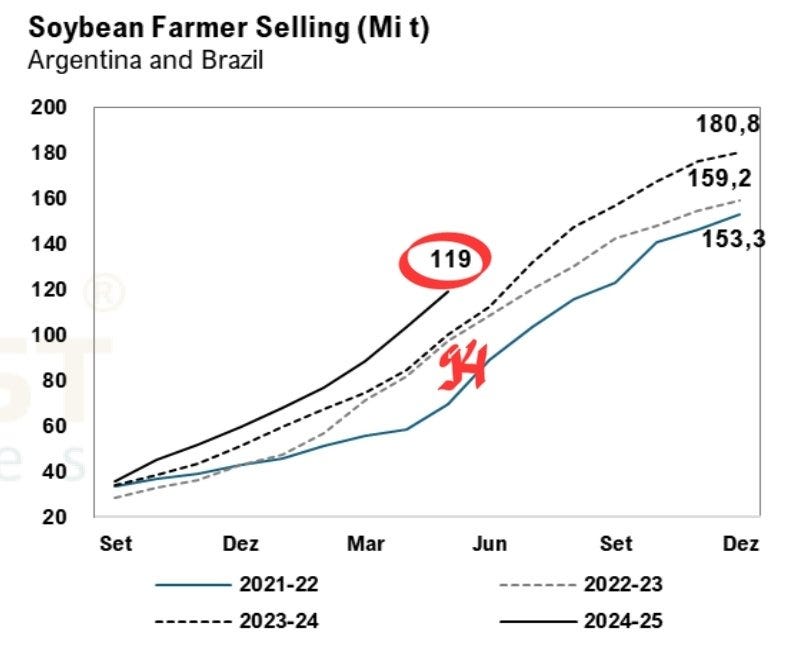

More interestingly, Julian projected that farmer selling would catch up to the seasonal average by the end of June. That’s exactly what we’re seeing (see Javier’s chart below). It’s not just selling volumes that are climbing, but also the pace of crop pricing.

2 Contrasting Views of Soybean Price Action

Take a look at the total farmer sales in South America. There are two ways to view this.

There is still pressure to come to this market, and soybeans are setting up to disappoint as the Trade War 2.0 escalates again later this summer. China will not buy soybeans.

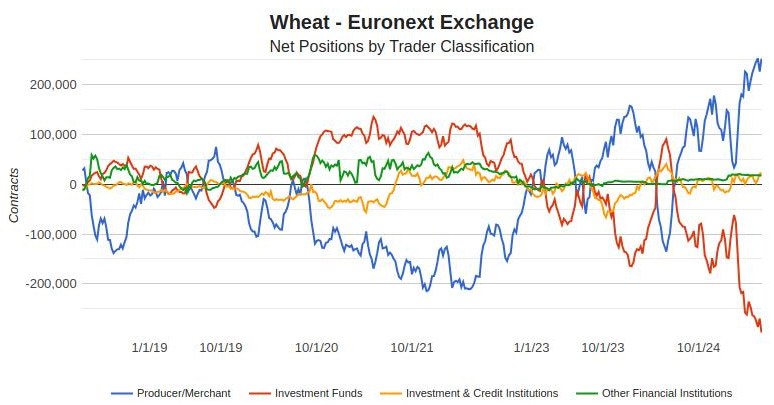

Soybeans are not a bearish commodity at $10. Farmer selling is getting absorbed by speculators, and cash markets have priced record crops across South America. The US risks losing acres in wet areas, and macro traders could favor soybeans (see ANDY’s comments on COT data below).

Angie, Eduardo, and I discuss the question, “Can China completely avoid US soybeans?”

The answer is no for several reasons, but the Trade War narrative keeps negative soybean headlines front and center.

If anything, the soybean situation is quietly developing a bullish fundamental setup in front of a weather market. We made the point earlier this week, so let’s see how the summer weather develops. Acreage for corn and soybeans could bring surprises—keep an open mind.

Does this Fit with Our April Thesis?

You be the Judge

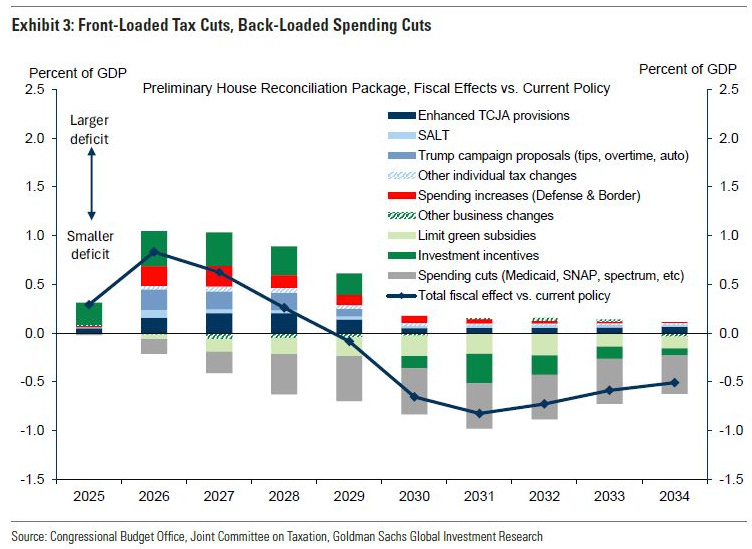

Our April note focused on the bullish grain sentiment being overdone (speculators too long corn) and a bearish macro picture developing. Since then, corn liquidation has come mainly through spreads and a small sell-off, and Trump reversed course on tariffs and is very close to passing a debt bomb tax bill that could spur the next wave of fiscal support to goose risk assets.

Keep an eye on the correlation with outside markets and the deterioration of trade data. Container rates and flows into West Coast ports are leading indicators. Here is an article about the recent volatility.

There is a growing risk that the tax bill will not get passed, which would curtail the growth outlook rapidly. Elon coming out against it provides cover for Republicans in contested states and fiscal hawks to speak up louder. The fight will get more contentious with scrutiny of all the pork. Copper, cattle, soybeans, and crude oil could all take direction from the success of the bill over the next 2-4 weeks.

China & Europe Require Monitoring, Nothing to Trade

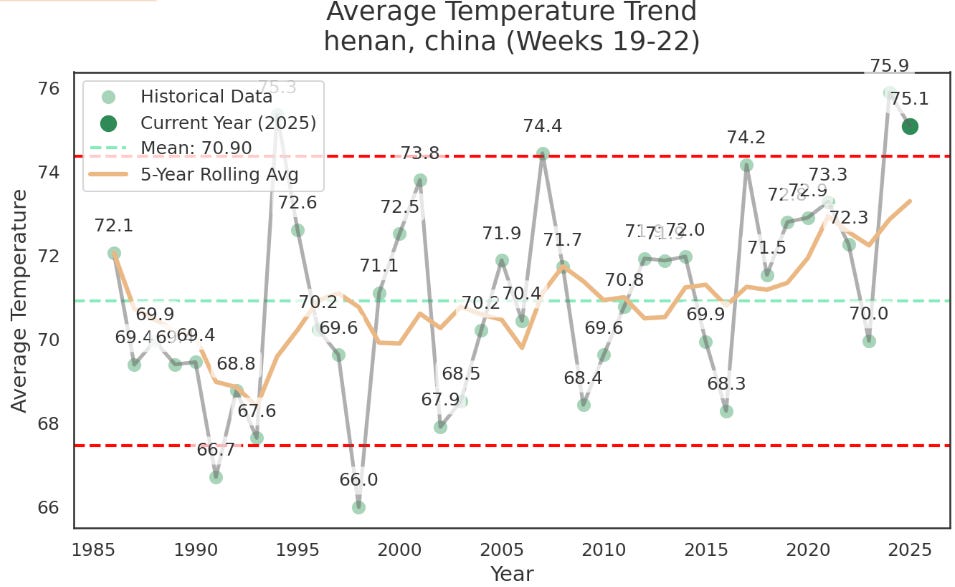

Recent headlines have highlighted extreme weather conditions in China, but much of the impact thus far has been concentrated in winter wheat-producing regions, which are now being harvested. AiQ has reduced its winter wheat forecast by 8% due to sustained heat stress and has trimmed corn production estimates slightly to 290 MMT, primarily reflecting a modest reduction in planted acreage rather than yield adjustments.

Before all the new “Henan” experts start talking about how obvious the heat is, look at the average temps a year ago. China produced record corn and wheat crops, and the reserves from a year ago provide an initial buffer to any losses this year.

While it's still too early to make definitive yield cuts for corn, persistent heat across large parts of the country warrants close monitoring. Notably, far northern Inner Mongolia continues to miss out on meaningful rainfall. In contrast, most major corn-growing provinces have received some precipitation, offering support to crop conditions—but ongoing heat remains a risk factor.

A main takeaway is that many of these regions receive little rain this time of year, confirming that it is too early to get bullish on summer crops.

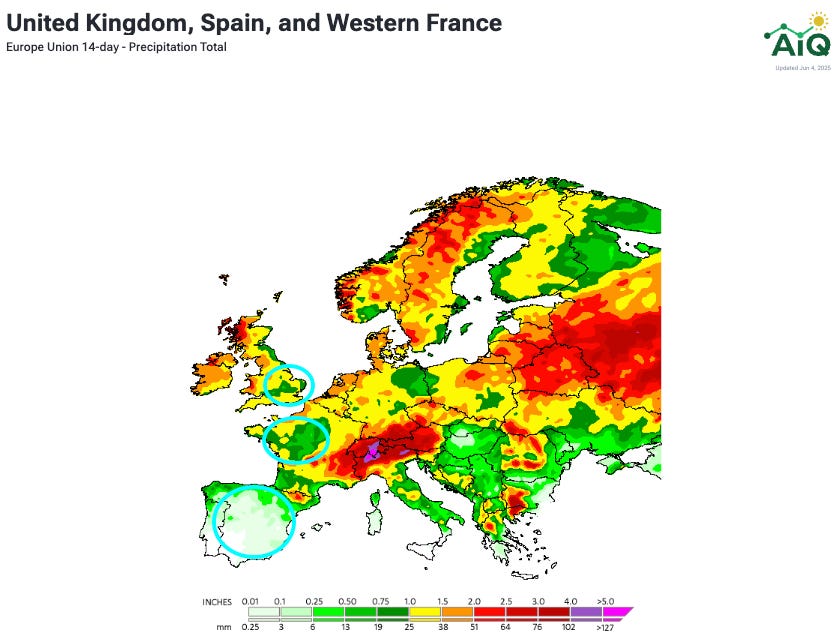

The weather in Europe has had small pockets of problems in a handful of areas. The following are all worth monitoring:

Southeast United Kingdom (Wheat)

Western France (Rapeseed, Wheat, Barley, Corn)

Ukraine (Wheat, Rapeseed, Sunflower, Corn)

Spain (Corn)

None of these weather concerns is worth a trade today. The strong Euro keeps pressure on local markets—easily visible via the wheat short in Matif. The Euro could push to new 4-year highs in the next week. The Japanese Yen is also poised to test a triple top against the dollar. While videos of snow and poorly conditioned wheat in Ukraine have been a fun social media topics—a much bigger catalyst is needed.

How Could We Ignore the US in May?

Each spring, ag newsletters search for headline-worthy stories. Sometimes they find one, but more often they don’t. This year falls into the latter category. So far, there’s simply not much to write home about. That could change by mid-June, when the summer weather market kicks off.

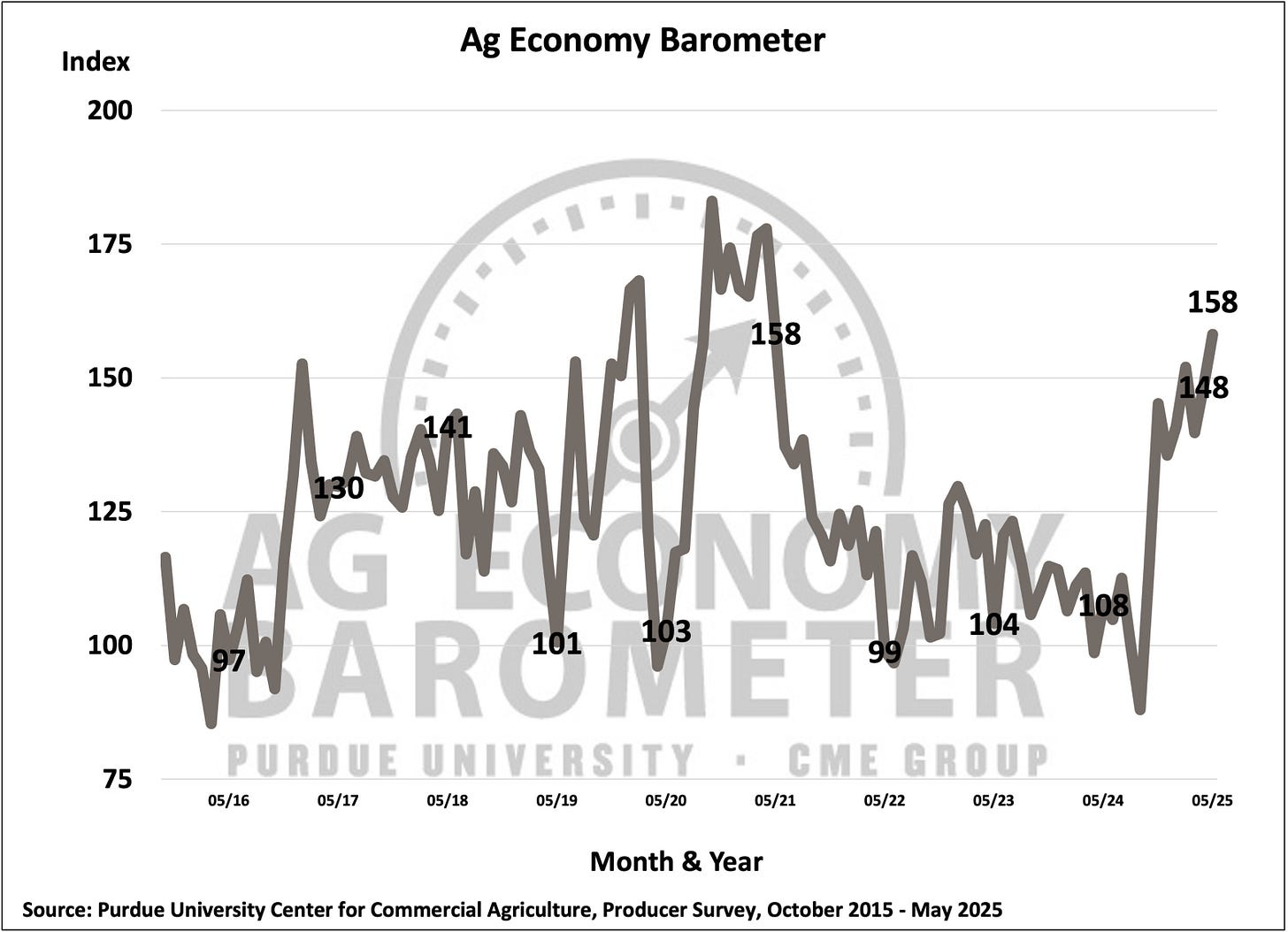

For now, the biggest variables for U.S. farmers remain acreage allocations, trade flows, and policy direction. If there’s been any notable shift, it’s in sentiment—an uptick in optimism, perhaps tied to Trump’s renewed tax-cut proposals and direct payments for the ag sector. But let’s be clear: it’s not margin-driven optimism, especially with corn struggling to stay above $4.50 per bushel.

The only area in North America facing an ongoing drought is Northwest Mexico. Sinaloa is the largest corn-producing state, but it is basically a desert—only getting 1.2 inches in the first 5 months of the year.

You Don’t Trade Vol Bro

As we prepare to roll out a new suite of option tools and market insights, it’s worth taking a moment to review the fundamentals—and correct a few common misuses.

These tools enhance the timing and structure of hedges or speculative bets and provide real-time guidance on whether options or futures are more efficient for a given market condition.

Let’s start with a foundational concept: options are precision instruments, not blunt-force tools. They come with built-in leverage and asymmetric risk profiles. Few traders truly understand when their trades are more exposed to time, movement, and path dependency.

I specifically avoided the word “volatility” in the explanation. If you are interested in why, consider implied volatility and realized or historical volatility. Most traders talk about these interchangeably, but implied volatility is a rough calculation derived from price. Further, a trader buying an option is most often making a forecast of movement. Usually, the bet they have made is driven by gamma or path dependency, and they rarely know when it is which.

Take, for example, the widespread use of three-way option structures among cattle and hog risk managers. These strategies are popular because they offer downside protection, limited upside participation, and triple the commission. But what often gets overlooked is the real cost: opportunity loss. These structures frequently cap the upside just when businesses should be adding risk or leveraging time.

Similarly, in grain markets, end users and speculators tend to chase volatility during peak uncertainty. As a result, they pay a premium for implied volatility just as everyone else is doing the same. Their rationale becomes “insurance on a weather bet” when it inevitably does not pay off.

This drives up the variance premium—the spread between implied and realized volatility. Even when that premium looks “cheap” due to a low flat price or lack of compelling narratives, not understanding their asset has a cost, which usually manifests in poor position management.

In short, options should not be approached casually. Their real value emerges when you understand what they’re measuring, what’s priced, and what the market is missing. We’ll be covering that—and more—in the coming weeks. Stay tuned.

Rest assured, even when you buy a call or straddle, you are not trading vol bro!

Thank you for reading. Please reach out to Nico@archaiq.ai with any suggestions on how to improve our products or if you're interested in exploring new opportunities with ArchaiQ. Sign up for our free weekly newsletter at www.archaiq.ai.

This is not trading or investment advice. Trading Futures is a high-risk activity; please consult with a professional.