🇺🇸 Planting Prospects Split East from West on Acreage Expectations (May 23, 2025)

Bonus: What Does the Kindleberger Trap Suggest About Trade Assumptions

Planting Prospects Split East from West – Acreage Estimates Diverge

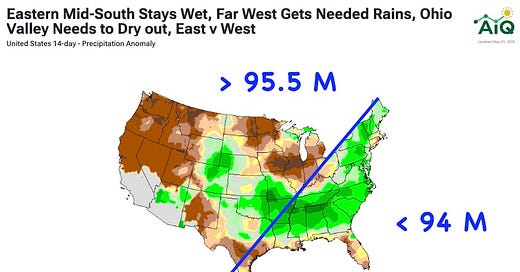

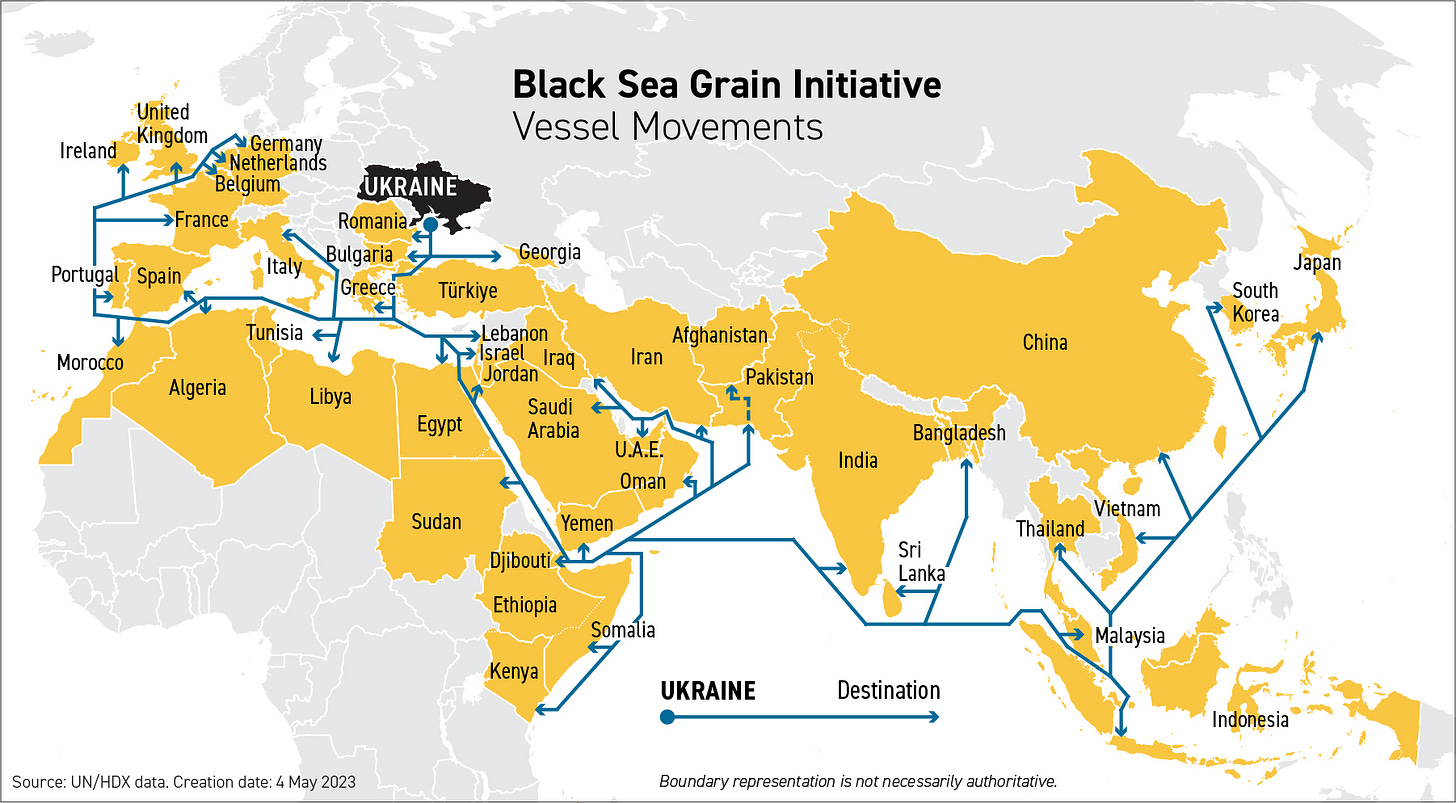

The defining storyline this planting season is the stark East-West divide across the U.S. farm belt.

In the Western Corn Belt, planting has moved swiftly, and weather has mostly cooperated. Optimism is building among analysts and producers alike, with some now projecting corn acreage could stretch toward 96.5 to 97 million acres—a clear signal that farmers are leaning in hard where conditions allow.

Meanwhile, in the Eastern Corn Belt, it’s a very different tone. Analysts point to a mix of cost pressures, weak margins, limited input availability, and soggy fields as reasons many growers are behind schedule or opting to cut back. Acreage estimates are being revised down—some as low as 93.5 to 94 million acres.

Soybeans stand to benefit in the second scenario thanks to their later planting window, which extends comfortably into early July.

The result? A USDA report teed up for heightened volatility, as the bias for acres—higher or lower—remains up in the air and at the mercy of weather in the weeks ahead.

The Midwest does NOT have a Problem

There’s a widely held belief that corn yields could underwhelm again this year, shaped by consecutive years of below-trend results. But let’s be clear—2025 is off to a strong start. Planting progress is ahead of schedule, and early conditions are favorable across much of the Midwest and Western corn belt. For now, yields aren’t a serious concern in May unless you are pushing a bullish agenda.

The biggest risk at this stage is that eastern analysts are right, and 1 to 2 million acres quietly shift to soybeans. While there’s little hard data to confirm such a move yet, it’s a risk worth tracking.

The main question: What will the USDA report in June?

Can China Zero Out Its US Soybean Purchases? The answer is no, and still, probably not.

Here is a chat with Eduardo Vanin and Angie Setzer about this topic. Eduardo lays out the objective case for why China will likely buy a minimum of 15 MMT from the USA. Angie points out the hilarity of balance sheets 112 = 112… No, they can’t just swap.

There is a more nuanced argument about trade in agriculture and food. The idea that agriculture will be foundational to these agreements is misplaced. It will make for great headlines, but it will not drive policy. Soybeans have been a focal point for Trade Wars 1.0 and 2.0 BECAUSE the US doesn’t export much else to China. The US leverage comes from restricting access, not making grain flow.

Global trade flows will continue, and food will be the LAST traded good weaponized—even after water. And water leads to wars (the Pakistan-India water conflict here).

Assumptions About Trade & the Kindleberger Trap

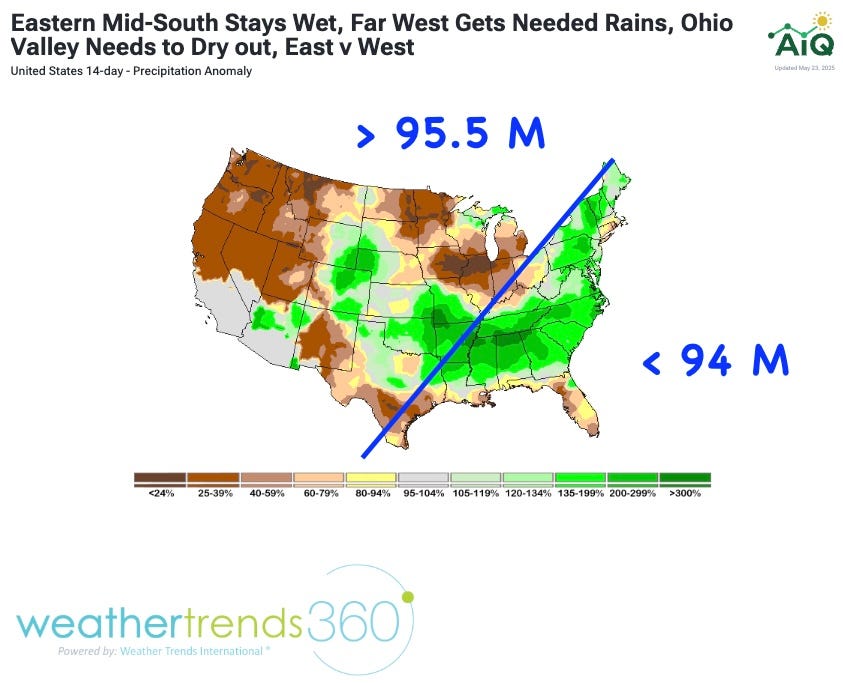

The origins of Kindleberger’s work were less about a “trade doom spiral” and more about what happens when a global vacuum develops and protectionism takes hold.

The Kindleberger Effect refers to the idea that during times of global financial crisis, a single dominant country—typically the United States—must act as a lender of last resort to stabilize the system. Named after economist Charles Kindleberger, who studied the Great Depression, the effect emphasizes that without leadership to provide liquidity and coordinate policy, global markets can spiral into deeper panic and disorder. In essence, it's a call for hegemonic responsibility in moments of systemic stress.

AiQ’s criticism of all abusive tariffs is the second-order effects and externalities. Countries that start down a protectionist road rarely turn back. Protectionism in trade will quickly spill over into current/capital accounts and all policy aspects—weaponizing financial support, taxes, migration, remittances, IP-access, etc. This course inevitably results in choosing national champions, promoting inefficiencies, and

Ag Trade Flows Will Adjust, Not be Coerced

I have heard the argument that agriculture will be an easy throw-in or win for the Trump agenda. Countries will choose to buy agricultural commodities because they need them, and it’s a logical concession while negotiating the stickier points.

People will immediately point to Canada and say, “Look at their tariffs on dairy; Trump needed to fix this.” Trump can fix this. Canada’s provinces are so protectionist that Canada needed a trade deal with itself.

If you think Trump fixed this in 90 days, or either country will put dairy over automotive, I have a Nigerian bridge for sale you will love.

Another challenge is that countries' interests concerning specific agricultural issues are rarely aligned. India’s vegetarian diet aligns with Canada’s lentil production, not America’s protein-heavy diet. America’s biofuel domestic ambitions keep India’s world-leading demand for vegetable oils often priced out. Rarely do Mexico's pork and corn deficits and the production of its northern neighbor fit so well.

Food is a top national security interest for every single country that does not produce enough or relies on the votes of its farming base. Global trade flows need to adjust to this reality, not be coerced into a new one.

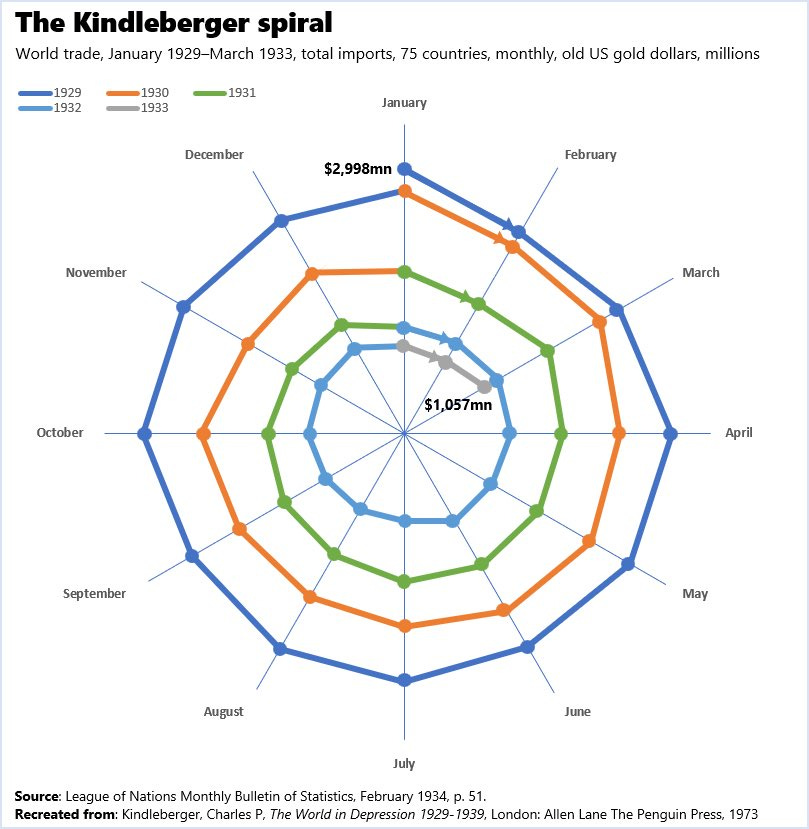

If you need proof, look at the Russian-Ukrainian War. A war that began with a clear aggressor that was universally condemned as “in the wrong.” Western power unleashed the most vicious sanctions to date, going so far as to freeze the assets of private citizens who had nothing to do with the war.

Yet, all parties came together to ensure the free movement of grain. If anything, pushing food supplies to needy countries became its own virtue signaling.

Thank you for reading. Please reach out to Nico@archaiq.ai with any suggestions on how to improve our products or if you're interested in exploring new opportunities with ArchaiQ. Sign up for our free weekly newsletter at www.archaiq.ai. Each morning, we will add some daily notes to our Substack chat (link here).

This is not trading or investment advice. Trading Futures is a high-risk activity; please consult with a professional.